Hotel Lawyer: Where are we in the hotel cycle? What's the real threat of new supply? Where do we go from here? | By Jim Butler

By Jim Butler, Hotel Lawyer | Author of www.HotelLawBlog.comHotel Lawyer reporting from Meet the Money® hotel financing conference. At the recent Meet the Money® conference on hotel financing, Mark Woodworth, Executive VP of PKF Consulting, presented the latest report from PKF Hospitality Research to a crowd of more than 450 hotel industry leaders who gathered to connect with all the top debt and equity financing sources for hotels and hotel-related projects. (For more details on the Conference or the materials from it, see "Hotel financing gateway. Meet the Money® -- gateway to debt and equity financing for hotels. How to get your hotel financed.")

Mark Woodworth's presentation helped answer the questions on everyone's minds: (1) Where are we in the hotel cycle? (2) What is the real threat of new supply? and (3) Where do we go from here?

His information and answers were very interesting . . .

The questions about the hotel industry that are on all our minds

(1) Where are we in the hotel cycle?

Adding to the valuable data provided by Bobby Bowers of Smith Travel Research, reported on www.HotelLawBlog.com (see "Hotel Lawyer on latest U.S. Hospitality Trends from Meet the Money® hotel financing conference"), Mark Woodworth started things off by saying that "Things are great!"

- Profits: Up 44% since 2003!

- Cap Rates: Spreads 38% below historic norm!

- Values: Prices keep going up!

But where are we in the cycle? Are we nearing the peak? Are the good times about to come to an end?

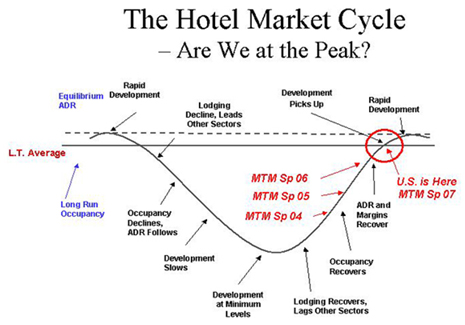

Here is Mark's graphic demonstration of where he thinks the U.S. hotel industry is in the cycle, and also where it has been the past several Meet the Money® sessions.

Importantly, Mark notes that ADR has recovered and is still growing. (Note the long term trend lines for ADR and occupancy) Mark believes that the fundamentals are so good that although we are nearing a "peak," we may "plateau at the peak" for some time before riding into a down cycle.

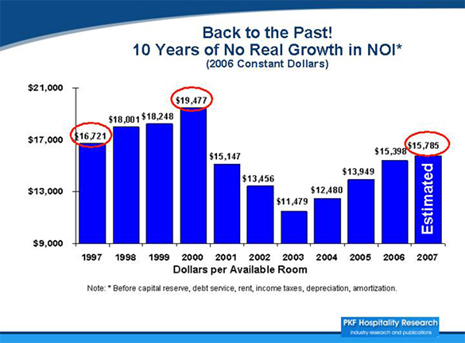

As the following chart shows, in real terms, we have not yet achieved any inflation-adjusted NOI growth from the 2000 levels. This is one factor that has dampened the economic justification for new hotel development, and consequent room supply growth during industry's recovery over the past 5 years.

(2) What is the real threat of new supply?

But what about the threat of new supply? The hospitality industry is one that usually creates its own speed bumps by overbuilding, driving up supply faster than demand, and then watching crumbling economics. Certainly we have seen a kick up in supply, but will the results be different this time?

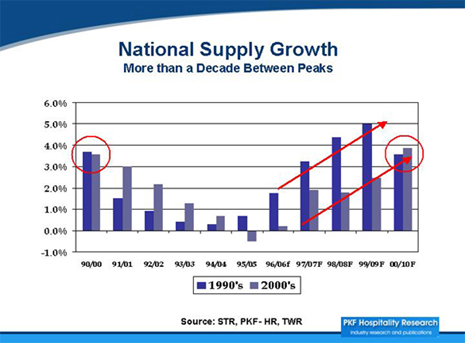

PKF research shows that there has been an incremental increase in the current construction pipeline, but Mark says, "We are nowhere near the last decade's level of product under construction." And here is Mark's slide comparing the year-to-year increase in supply during the decade of the 1990s to the current decade. PKF believes that new construction will accelerate, but at levels well below what the industry saw the last time around.

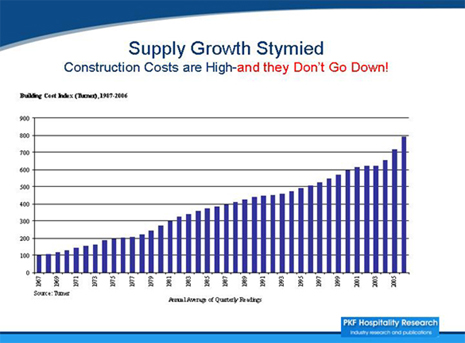

And a major reason that supply growth has dampened is the prohibitive cost of new construction, which as PKF notes, have gone up, but are unlikely to go down.

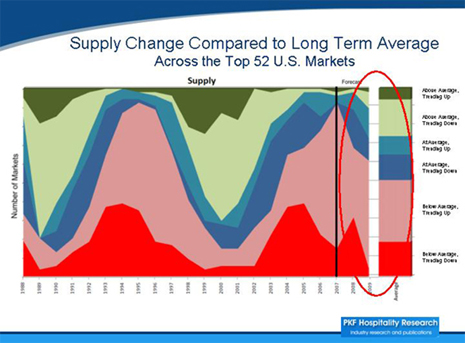

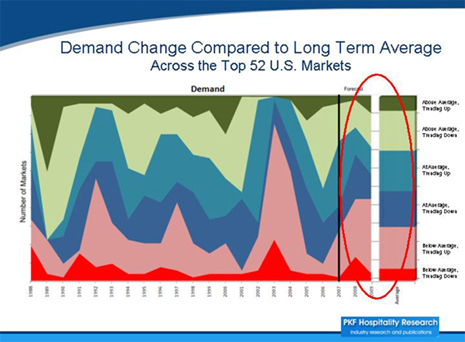

The practical, real-world consequences of all this is shown in this fascinating pair of supply and demand charts that puts supply and demand changes in perspective over the past 20 years across the top 52 U.S. markets.

(3) Where do we go from here?

Mark told the assembly at Meet the Money® that, "This is a wonderful time to be in the hotel business!" The industry's performance the past few years has been exceptional. The strength of fundamentals continues to attract capital.

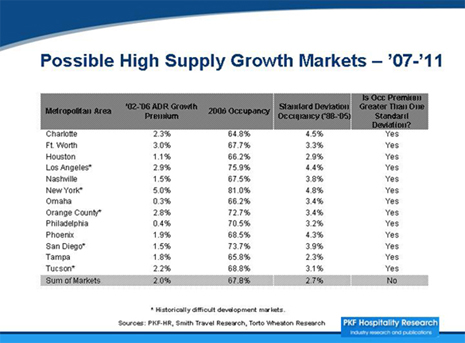

As supply ramps up, PKF sees a few high supply growth markets, which include some historically difficult markets such as Los Angeles, New York, Orange County, San Diego and Tucson.

PKF sees a slowing in the hospitality industry growth from the recent explosive few years, but compared to historic averages, things look good. PKF's summary of our situation and prospects.

- Strength of fundamentals continues to attract capital

- Transaction activity remains high - this condition will persist well into 2008

- Upward pressure on Cap Rates -values to level off

- Development costs remain high - no downturn in sight

- Hotel openings will begin in earnest in '09-'10

Is the "easy" money is behind us? Yes, and here's why:

- No more lift from cap rate compression

- Revenue growth will moderate

- Expenses keep creeping up: labor, utilities, property taxes

Even so, Mark's summary puts it all in context. We shouldn't forget his words when the doomsayers tell us the end is near. He said, "It remains a wonderful time to be in the hotel business!"

We couldn't agree more.

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $40 billion of hotel transactions, involving more than 1,000 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.

Our Perspective. We represent developers, owners and lenders. We have helped our clients as business and legal advisors on more than $40 billion of hotel transactions, involving more than 1,000 properties all over the world. For more information, please contact Jim Butler at jbutler@jmbm.com or 310.201.3526.Jim Butler

Phone: +1 310 201 3526

Email: jbutler@jmbm.com

Jeffer Mangels & Mitchell LLP (JMM)

https://www.jmbm.com/global-hospitality-group.html

1900 Avenue of the Stars, 7th Floor

USA - Los Angeles, CA 90067

Phone: (310) 203-8080

Jeffer Mangels Butler & Mitchell LLP Announces Firm Name Change as It Enters Its 45th Year

Labor and Employment Roundup: What to Expect in 2026

JMBM Guides Largest Hotel Sale in California in 2025