Hotel Lawyer: As goes the economy, so goes the hospitality industry — the ineluctable elasticity of demand! | By Jim Butler

By Jim Butler, Hotel Lawyer | Author of www.HotelLawBlog.comHotel Lawyer on hotel fundamentals. One of the things that has fascinated me about the hospitality industry for more than 20 years now, is the close — almost intimate — relationship of industry performance to the U.S. economy’s performance. Some might say this is intuitive, that when the economy does well, all business does well. But that is not always true. There are some businesses which do better in hard times, like discount and bargain stores, and there are some that seem impervious, like ultra luxury goods. However the relationship of the lodging industry’s performance to the general economy, has been carefully documented by the experts, and it is worth noting. The implications are interesting.

Industry analysis by PricewaterhouseCoopers

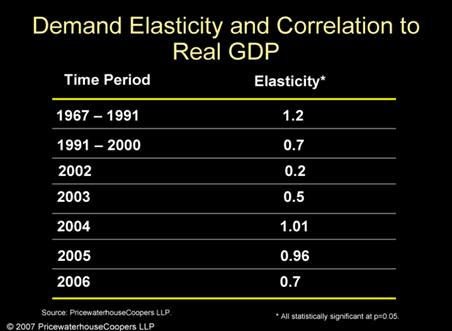

Bjorn Hanson, Ph.D. and principal, PricewaterhouseCoopers Hospitality and Leisure practice, explains this so well, as I watched him again at the recent Los Angeles hotel investment conference. And Bjorn was kind enough to share his graphics with me. Bjorn and economists speak of the “elasticity” of demand. In the case of the lodging industry and the U.S. economy, the relationship has historically had a very close statistical “correlation.” A correlation of “1” is a very high correlation establishing virtually a direct relationship between two items. As you can see from the following chart, the correlation between lodging demand and the U.S. Real GDP was 1.2 for 24 years from 1967 through 1991.

What does this mean? It means that if the U.S. economy grew by 1%, then lodging demand grew by 1.2%. This is pretty remarkable. But then, for about a decade between 1991 and 2000, the correlation dropped to .7. That meant that if the U.S. economy grew by 1%, then lodging demand grew by .7%. This is still a very impressive correlation, though not as strong as before.

Then, as you can see from the chart, everything changed in 2002 after 9-11, and the correlation plunged to .2 in 2002, rose to .5 in 2003, got to 1.01 in 2004, and has wobbled a bit the past two years, but still at a very high level of correlation or direct relationship.

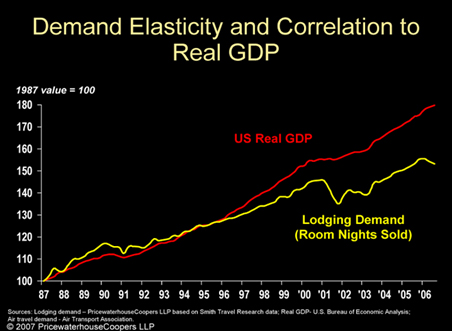

Here is another of Bjorn Hanson’s charts to illustrate the relationship a different way.

In this chart, you can see how the U.S. Real GDP and lodging demand tracked so closely from 1987 until 2002, and then virtually reset at a lower scale, but still paralleling the GDP.

This is an amazing correlation or relationship. Of course, the supply side of things is also critically important to the impact on profitability of the U.S. lodging industry, but these charts, and the correlations that PwC has documented show how important the economy is to our industry. No matter how strong the industry fundamentals may be — and they are very strong right now — the lodging industry will be directly affected by any economic downturn, as the demand growth will almost certainly parallel the GDP. More on industry fundamental for 2007 soon.

Jim Butler

Chair, Global Hospitality Group

1900 Avenue of the Stars, 7th Floor

United States - Los Angeles, 90067

Phone: +1-310-201-3526

Mobile: +1-310-968-4000

Fax: +1-310-712-8526

Email: jbutler@jmbm.com

Jeffer Mangels & Mitchell LLP (JMM)

https://www.jmbm.com/global-hospitality-group.html

1900 Avenue of the Stars, 7th Floor

USA - Los Angeles, CA 90067

Phone: (310) 203-8080

Jeffer Mangels Butler & Mitchell LLP Announces Firm Name Change as It Enters Its 45th Year

Labor and Employment Roundup: What to Expect in 2026

JMBM Guides Largest Hotel Sale in California in 2025