STR Weekly Insights: 6 - 12 October 2024

STR Weekly Insights: 6 - 12 October 2024

|

STR Weekly Insights: 6 - 12 October 2024

|

STR Weekly Insights: 6 - 12 October 2024

|

STR Weekly Insights: 6 - 12 October 2024

|

STR Weekly Insights: 6 - 12 October 2024

|

STR Weekly Insights: 6 - 12 October 2024

|

Countries/markets mentioned:

- United States: Atlanta, Las Vegas, New Orleans, New York City, Phoenix, Augusta, Florida Central North, Greenville/Spartanburg, Macon/Warner Robins

- Global: China (Guangdong, Shanghai), Italy (Milan, Rome), Spain (Canary and Balearic Islands, Madrid)

Highlights

- Hurricane displacement demand and calendar shifts push U.S. hotel performance growth

- Multiple markets impacted by Hurricanes Helene and Milton

- Group demand recovered from prior week but remained soft relative to 2023

- Taylor Swift’s Eras Tour returns to the U.S. for the next three weekends

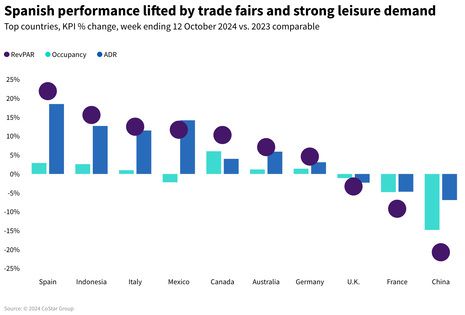

- Spain lifted by trade fairs and strong leisure demand

- China slows post-Golden Week

A combination of events lifted performance

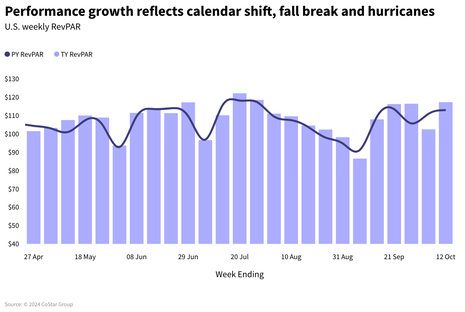

Hurricane impacts, calendar shifts, and fall break in different parts of the country combined to produce a solid growth week for the U.S. hotel industry. Revenue per available room (RevPAR) for the period ending 12 October 2024 increased 3.8% year over year (YoY) with occupancy rising 1.4 percentage points (ppts) and average daily rate (ADR) increasing 1.6%. Hurricanes Helene and Milton left residents in the Carolinas, Georgia and Florida in need of housing. Recovery crews entering affected markets also contribute lodging demand.

The Yom Kippur and Columbus Day/Indigenous Peoples’ Day calendar shifts along with fall break resulted in net positive demand. Because of the combination of events, day-of-week RevPAR results showed a mixed bag with Sunday producing a decrease (-6.2%) and Monday through Wednesday growing between +5.1% to +6.3%. Saturday was the next strongest day (+3.0%) followed by Thursday (+1.8%) and Friday (+0.7%). Markets in hurricane impacted areas, as well as those catering to conventions and leisure destinations all experienced noteworthy gains.

For the week, the Top 25 Markets saw RevPAR increase 4.1% with ADR up 2.1% and occupancy increasing by 1.5ppts. Top 25 Market leaders included New Orleans (+35.9%), driven by a convention (Water Environment Federation’s Technical Exhibition and Conference), and Atlanta (+20.6%), hosting the NRPA convention in addition to receiving people evacuating from Florida in the wake of Hurricane Milton. Tampa and Orlando, in the path of Milton, reported declines of 9.8% and 5.3%, respectively. RevPAR in the rest of the country rose 3.6% with occupancy (+1.7 ppts) driving the gain while ADR increased 1%. Top growth markets included Augusta and Macon/Warner Robins in George, Florida Central North and Greenville/Spartanburg, SC—all were impacted by hurricane displacement demand.

Among submarkets, Anderson/Clemson, SC saw the largest RevPAR growth (+92.6%) followed by Augusta CBD/North Augusta, Augusta Area/Aiken and Ocala, FL, where RevPAR increased by more than 82%.

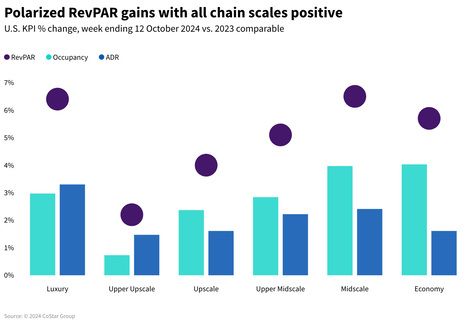

RevPAR increased across the chain scales in a polarized fashion with the greatest gains in Luxury (+6.4%), Midscale (+6.5%) and Economy (+5.7%). Occupancy was the primary driver of the RevPAR gains except in Upper Upscale. This occupancy strength is reflective of the above-mentioned combination of events driving demand. This was only the fourth time this year that all chain scales reported weekly RevPAR growth.

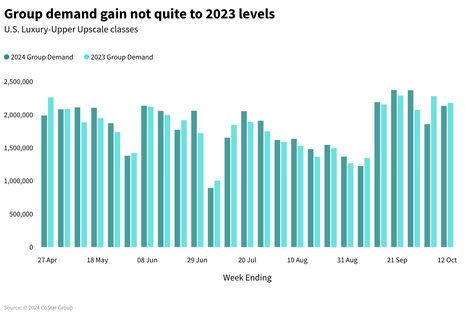

Group demand soft relative to 2023

Group demand in Luxury and Upper Upscale hotels recovered from the previous week’s decline, increasing 15.2% week over week. However, demand was down compared to the same week last year (-2.1%). Group demand was down in both the Top 25 Markets and the rest of the country, but there were several markets that recorded strong group demand. New Orleans, Las Vegas, Phoenix, New York City, and Atlanta all saw double-digit occupancy increases.

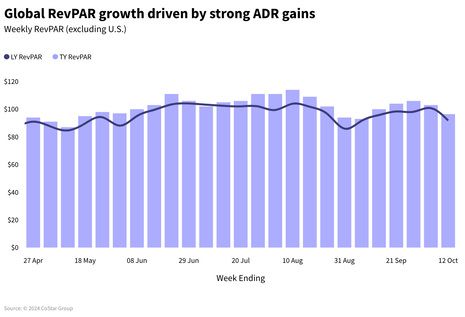

Global RevPAR continues to grow because of ADR

Global RevPAR (excl. U.S.) continued to grow, up 5% YoY. The weekly gain was driven entirely by ADR, which rose 8.5%, while occupancy declined 2.2ppts. By day type, weekdays (Monday-Wednesday) saw the strongest growth as RevPAR increased 7% on ADR (+12.7%) as occupancy declined.

Among the gainers, Spain led with a 21.9% RevPAR increase via ADR (+18.5%). Madrid saw the largest ADR increase, surging 48.9%, along with a 3.8ppts rise in occupancy, attributable to the Fruit Attraction trade fair, which drew over 100k attendees. Leisure markets like the Canary and Balearic Islands also posted strong ADR growth, up 6.2% and 13.9%, respectively.

Italy’s RevPAR (+12.5%) also rose on ADR growth (+11.5%). Milan led with ADR climbing 34.8% due to the CPHI medical congress. Occupancy at 83.9% was down slightly (-1.4ppts). Other markets showed steady gains, with Rome's ADR up 5.8% YoY and occupancy stable at 0.6ppts.

China’s RevPAR declined 20.7% following a fortnight of growth. At 55.8%, occupancy was at its weakest level since early this year. The measure fell across all 10 of the country’s largest markets with Shanghai down 11.5ppts and Guangdong falling 2.4ppts. The end of Golden Week and a working Saturday were likely reasons for these declines.

Looking ahead

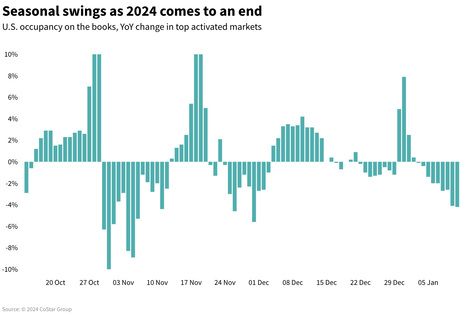

Results for the week ending 19 October 2024 are expected to be mixed due to Columbus/Indigenous People’s Day calendar shift and ongoing impacts from the two hurricanes.

Forward STAR data shows that demand comparisons will be negative at the start of the week with growth thereafter. Taylor Swift’s Eras Tour is back in the U.S. with positive impact expected over the next three weekends, starting in Miami followed by New Orleans and Indianapolis. Global performance is also expected to remain positive for the rest of the month.

*Analysis by Isaac Collazo, Chris Klauda, Will Anns.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

STR Weekly Insights: 29 September – 5 October 2024

STR Weekly Insights: 13-19 October 2024

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

Hotel pipeline activity increased globally, except in Middle East and Africa

U.S. hotel results for week ending 12 July

U.S. hotel construction fell for sixth consecutive month