STR Weekly Insights: 29 September – 5 October 2024

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

STR Weekly Insights: 29 September – 5 October 2024

|

Countries/markets mentioned:

- United States: Augusta, Charlotte, Chicago, Columbia, Dallas, Detroit, Florida Central North, Houston, Las Vegas, Macon/Robbins, Miami, Tampa, Sarasota, Seattle

- Global: Australia (ACT & Canberra, Brisbane, Melbourne), China, Indonesia (Central Java), Mexico

Highlights

- Previous week’s strong growth deflated due to calendar shifts

- Upper Upscale chains posted the largest RevPAR decline of 2024

- Positive demand trends emerged in the Carolinas and Georgia as Hurricane Helene recovery began

- Group demand retreated nationally

- Hurricane Milton impact will be seen in next week’s data

- Global RevPAR eclipses $100 again

- China shows Golden Week impacts

- Spring has sprung in Australia, lifting hotel performance

- Mexico performance down due to storm activity

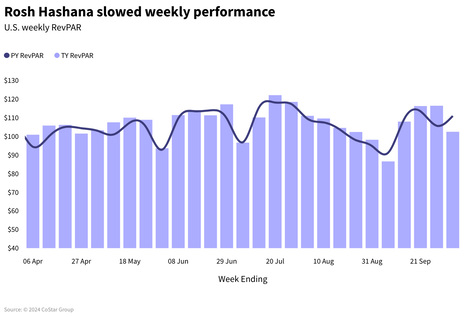

Calendar shifts slow hotel performance

On the heels of strong gains the previous week, U.S. hotel performance for the period ending 5 October 2024 showed the effects of Rosh Hashanah and Columbus Day/Indigenous Peoples Day calendar shifts as well as the impact of Hurricane Helene. Revenue per available room (RevPAR) dropped 7.7% year over year with average daily rate (ADR) retreating 4.4% and occupancy falling 2.3 percentage points (ppts).

All days of the week showed declining RevPAR with decreases accelerating Wednesday (the start of Rosh Hashanah) and the largest declines coming from hotels located in the Western U.S. (-10.1%). The impact was especially pronounced in Las Vegas (-25.9%), which saw group demand fall 16.5%. Additionally, with the weekend ahead of Columbus Day/Indigenous Peoples Day included in the comparable period last year, weekend percentage changes worsened.

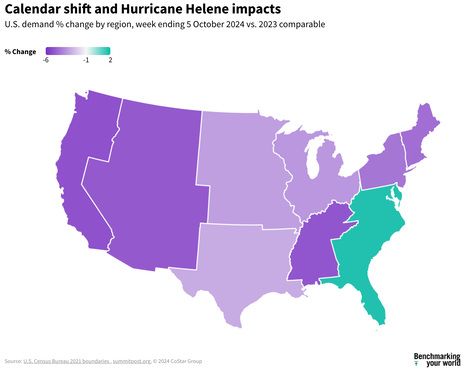

Hotels in the Northeast also saw a sharp decrease in RevPAR (-7.1%), but unlike the U.S., the largest drop for those markets occurred on weekdays (-9.5%). Confounding performance was the impact of Hurricane Helene and subsequent resident displacement into hotels. While room demand decreased from -3% to -5% across eight of the nine U.S. census regions, the South Atlantic experienced a demand increase of 1.7% with most of the increase in North Carolina, South Carolina and Georgia, where Hurricane Helene had the most impact.

Specific markets in the path of Hurricane Helene and the resulting flooding were Columbia, Macon/Robbins, Florida Central North, Augusta, Sarasota and Charlotte, all posting RevPAR gains of 25% or more year over year. Occupancy gains YoY exceeded 15 percentage points in all markets except Augusta. Hotels in hard hit Asheville were down significantly, however, it is difficult in this early stage to accurately represent performance given the extensive damage to properties in the area.

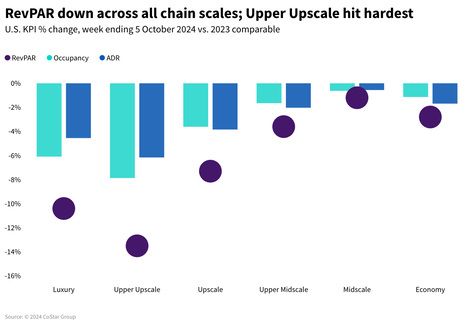

All chain scales posted RevPAR declines with the top three affected the most by calendar shifts. RevPAR in Upper Upscale fell 13.5%, which was the largest decline in 2024, the result of both declining ADR (-6.2%) and occupancy (-5.9ppts). Luxury followed with RevPAR falling 10.4% and Upscale posting a 7.3% decline. Midscale chains saw the smallest RevPAR decrease (-1.2%) followed by Economy (-2.8%) and Upper Midscale (-3.6%)

The Top 25 Markets saw a larger performance decline than the rest of the country. ADR reverted 7% and occupancy dropped 4.1ppts, resulting in a RevPAR decrease of 12.2%. In addition to Las Vegas, other top markets seeing RevPAR declines of -20% or more included Chicago, Miami and Dallas. Tampa, Houston, Seattle and Detroit were the only markets to post RevPAR gains.

Tampa saw increased demand post-Hurricane Helene, likely associated with recovery efforts. Further impact can be expected in next week’s data due to Hurricane Milton.

Group activity lifted Seattle and Detroit, while Houston continued its strong performance due to a variety of factors. Markets outside the Top 25 saw RevPAR decline 3.8%.

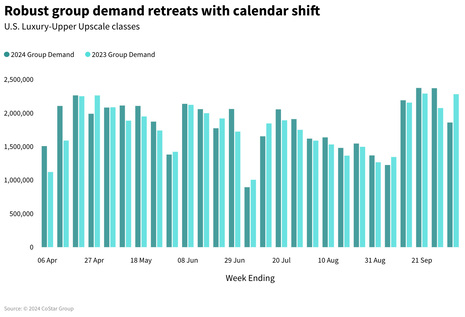

After posting a record demand increase the previous week, group demand in Luxury and Upper Upscale hotels retreated 18.3%, while transient demand increased slightly (+0.9%). ADR revealed a different pattern with group ADR down 1.8% and transient ADR decreasing 7.9%.

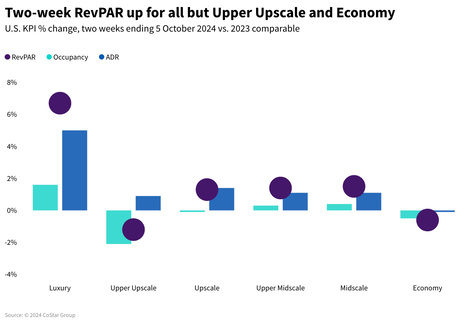

More balanced performance over the past two weeks

Combining the past two weeks to account for calendar shifts, RevPAR increased 1.2%, driven entirely by ADR (+1.5%) while occupancy was essentially flat (-0.3ppts). For the Top 25 Markets, RevPAR was up 2.2% with the rest of the country gaining a modest 0.5%. RevPAR increased in four chain scales: Luxury, Upscale, Upper Midscale and Midscale. Comparisons in the Upper Upscale and Economy segments remained negative at -1.2% and -0.6%, respectively, driven almost entirely by occupancy declines.

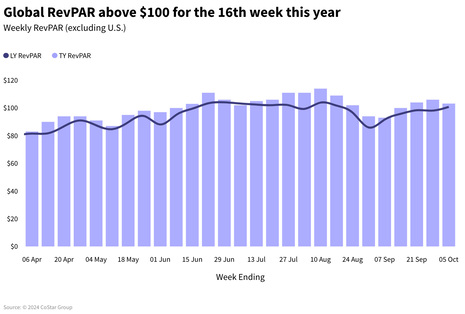

Global RevPAR exceeded $100 for the 16th week this year

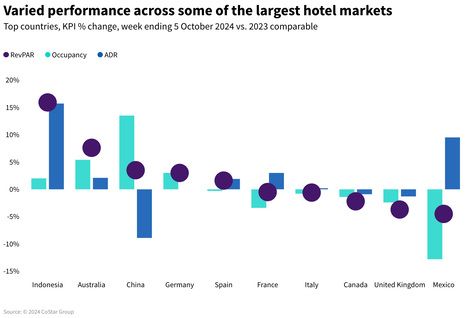

Global performance was driven primarily by an occupancy rise of 1.3ppts to 71.2%. ADR growth was more modest, increasing 0.4%. Overall, RevPAR climbed 2.4% to $103, marking the 16th week this year that RevPAR has exceeded $100. However, excluding China, global occupancy fell 1.3 ppts while ADR increased 4.2%. China’s performance was impacted by the Golden Week holidays, which drove occupancy (+8.8ppts) but weakened ADR (-8.9%).

Aligned with spring school holidays, Australia’s RevPAR jumped 7.6% on a 3.9ppt rise in occupancy with ADR up 2.1%. Occupancy gains were recorded in all but one market (Melbourne: -1.6ppts). Brisbane led the way with a 13.5ppt increase, followed by ACT & Canberra, up 10.3ppts.

Indonesia continued to see strong growth, with performance driven entirely by ADR, up 15.7%. Key market ADR drivers included Central Java (+26%) and Bali (21.6%), benefiting from robust international demand alongside a boost from corporate and government business.

Recent storms and hurricanes have significantly affected hotel performance throughout Mexico, leading to noticeable declines in occupancy across various markets.

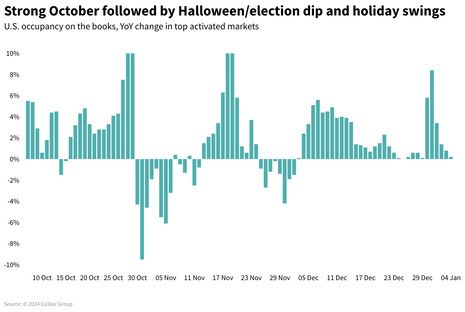

Looking ahead

It was a rough week for the U.S. hospitality industry. Tthe week ending 12 October should show improvement based on STR’s Forward STAR data—even though Yom Kippur occurs at the end of that week. However, the impact of Hurricane Milton may soften demand. Markets impacted by both Hurricane Helene and Hurricane Milton will be monitored as recovery efforts take place. The remainder of October looks positive up until the week of Halloween, which occurs on Thursday this year. Global performance is expected to remain positive throughout the month of October. China performance is starting to turn positive, possibly impacted by the recently released economic stimulus plan.

*Analysis by Isaac Collazo, Chris Klauda, Will Anns.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

STR Weekly Insights: 22-28 September 2024

STR Weekly Insights: 6 - 12 October 2024

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

Hotel pipeline activity increased globally, except in Middle East and Africa

U.S. hotel results for week ending 12 July

U.S. hotel construction fell for sixth consecutive month