Financing Your Indoor Waterpark Resort in 2010 | By David J. Sangree, MAI, CPA, ISHC and Eric B. Hansen, AIA, ISHC

Financing Your Indoor Waterpark Resort in 2010

|

The big question for 2010 is as follows: After two years of the frozen tundra in lending, are the capital markets beginning to thaw? Amid a plethora of opinions and sentiments, both positive and negative, where does reality come into play? Yes, the capital markets are beginning to thaw. Some financing has become available and transaction volume has increased, but this has been mainly for distressed properties. There has still not been any movement for new construction lending in 2010, just as there was not any significant new lending in 2009. The bottom line is that financing a new construction hotel and indoor waterpark resort remains extremely difficult.

Due to a lack of confidence in a market that has been ravaged by an economic recession, numerous bank foreclosures, and uncertainty regarding future regulations, lenders have pulled way back on financing new construction projects of all types.

When capital starts to flow again, what will characterize the deal, the deal makers, and the development project itself? This article describes the types of financing that are generally available, the characteristics of the developer, the lender, and the typical indoor waterpark resort development. A discussion of the challenges to obtain financing is followed by suggestions to overcome those obstacles.

Financing Indoor Waterpark Resorts

Indoor waterpark resorts have been financed through a variety of methods including the following:

- Traditional banks

- Investment bankers specializing in the hospitality industry

- Wealthy individuals

- Self-financed through cash flow of other properties

- Government backed bonds, loans and grants

Our interviews with various lenders and developers reveal that high levels of persistence, innovation, capital, and creativity are required in 2010 for pulling together project financing from a variety of sources.

David J. Sangree, MAI, CPA, ISHC, and Eric B. Hansen AIA, ISHC, interviewed various lenders and investors concerning the financing of indoor waterpark resorts in June 2010. Similar to 2009, the overriding message lenders provided to us was that currently there is a lack of financing for new construction hotels with or without indoor waterparks, particularly for larger projects. Although a few hedge funds have started to offer money, their fees are extremely high for the borrower. Most banks are not interested in a hospitality loan unless the borrower is credit worthy.

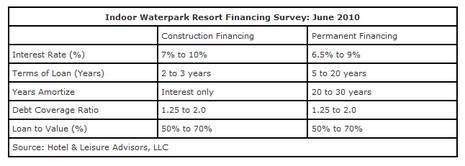

The following chart summarizes the rates and types of financing commonly used with indoor waterpark resorts for a borrower who is creditworthy and has strong liquidity.

The rates quoted for the 2010 survey indicate that lenders remain as cautious as ever. According to our survey, compared to 2009, loan to value ratios remain lower although some lenders are willing to consider the 60% to 70% of market value range. The mezzanine loan market has begun to open up, and some mezzanine lenders are considering investing in hospitality projects. As of June 2010, lenders are considering new construction primarily for smaller developments of $5 to $10 million or less, which typically can have a SBA guarantee, and larger projects are still having great difficulty finding interested lenders. We are aware of three separate larger projects that are working to utilize both tax-exempt and taxable bonds to develop the project.

Developer Characteristics

A developer of an indoor waterpark resort needs many strengths to develop this type of resort destination. The following describes some of the major characteristics which lenders and investors consider.

Developer Expertise

- Having prior development experience with success is fundamental to a lender. Be prepared to support claims of prior projects coming to fruition on time and within budget. The development of a strong business plan illustrates the developer's expertise and commitment to success.

Management Expertise

- Lenders are looking for owners who are engaged in the knowledge of operations and who know the intricacies of both an indoor waterpark resort and of a hotel. Many potential lenders not familiar with indoor waterpark resorts are, however, familiar with hotel operations.

Sufficient Collateral and Capital

- The proverbial 'skin in the game' needs to be clearly evident in the form of equity and a personal guarantee. Lenders we interviewed are looking at a cash infusion of 20% to 50% of value in addition to solid securitization of the loan amount. Typically, lenders require a higher equity contribution for an indoor waterpark resort loan than for a more traditional hotel loan.

Each of these characteristics carries weight in the decision to lend. Prudent developers will analyze their own strengths and weaknesses and determine how each of these characteristics should be enhanced to provide the lender with the best, most solid development team for the proposed project. The lender is searching for confidence in the ability of the developer to repay the loan.

Lender Characteristics

If a lender is willing to initially consider your project, then there are several attributes that, if present, will help generate a potential positive lending decision.

Familiarity

- How well does your lender know the market in which your resort is operating?

- How knowledgeable in hospitality and waterpark operations is your lender?

Understanding that Cash Flow is King

- Lenders require the property's projected cash flow to be sufficient to easily cover the projected debt payments. Cash flow projections must be clearly defined and have reasonable bases. The lender will scrutinize the financial projections and pro-forma.

- Lenders utilize the NOI to determine the debt coverage ratio for the loan. Lenders we interviewed require debt coverage ratios typically from 1.25 to 1.5. During the course of the loan, if the ratio is surpassed, then they could call for an infusion of cash to bring the loan amount back within terms of the note. The ability to do this on the developer’s part confirms the strength of the developer.

In general, the willingness of the lender to be educated on the project needs to be present from the beginning.

Indoor Waterpark Resort Project Characteristics

Indoor waterpark resort projects are family-oriented leisure properties that have multiple layers of complexity in regards to revenue generation and operations. Broad-based characteristics of these properties are as follows:

Size and Features

- Hotel & Leisure Advisors (H&LA) defines an indoor waterpark resort as a hotel facility connected to an indoor waterpark with a minimum of 10,000 square feet of indoor waterpark space with amenities such as slides, tubes, and play structures. Many hotels with large swimming pools claim to have an indoor waterpark; however, these do not fit our definition of an indoor waterpark resort and should technically be referred to as hotels with water features.

Branding

- Many of the early indoor waterpark resorts were independent properties. In recent years, franchised waterparks have become more common, but independent properties still dominate the market. Franchised properties typically are smaller hotels which also target corporate demand. Independent properties tend to be larger facilities which are focused on leisure demand.

Performance

- In equivalent markets, most indoor waterpark resorts perform better in occupancy and ADR than hotels that do not have indoor waterparks. This fact, on the surface, provides the foundation for a project that is feasible. However, there has to be enough revenue from various sources at the resort to justify the expenses. The bottom line NOI depends highly upon the expertise of the management team and its ability to manage the resort’s revenue and expenses.

Challenges in Financing an Indoor Waterpark Resort

Indoor waterpark resorts have proven to be more difficult to finance than typical hotel properties or other commercial properties. The difficulty in financing an indoor waterpark resort comes, in part, from the fact that it is both a hotel and an amusement attraction. Below are characteristics of these unique properties which make financing them difficult:

Larger Scale and Greater Costs

- They are bigger: Indoor waterpark resort projects are generally larger in scale and require larger development loans.

- They cost more to build: The development costs for an indoor waterpark resort are typically much higher than for many hotel properties. Most properties can cost between $200,000 and $400,000 per available room when indoor waterpark costs are included. The indoor waterpark itself may cost from $200 to $600 per square foot of net indoor waterpark space.

Higher Risk

- They are hotels: Hotel income, which relies on daily variations in occupancy, is less stable and predictable than income for properties secured by long-term leases. Therefore, they may be viewed by lenders as a high-risk situation.

- They are amusement facilities: The addition of an indoor waterpark to a hotel creates more of an entertainment destination, and, in spite of the success of many existing indoor waterpark resorts, some bankers perceive amusement facilities to be riskier than other types of commercial property.

- There are not many of them: The number of indoor waterpark resorts which exist in the United States is quite small – approximately 129 with indoor waterparks over 10,000 square feet. Therefore, lenders are generally unfamiliar with the dynamics of these properties. A developer may need to spend extra time to educate a lender when trying to acquire a loan.

- Seven indoor waterpark resorts have gone into bankruptcy or been foreclosed in the Midwestern states between 2009 and 2010. However, 122 properties in the U.S. are still operating and have not had documented lender problems.

Branding

- Developers find it easier to obtain financing for franchised properties than for independent properties because lenders tend to view franchised properties as more economically stable and less risky.

Overcoming the Challenges

A developer may counter these difficulties in obtaining financing by preparing a comprehensive package of documentation for a lender. A developer should consider the following items when putting together a comprehensive loan package.

Lender Education

- A loan officer's familiarity with both the hospitality industry and amusement related properties are vital. An educated hospitality lender well-versed in waterpark resort projects will alleviate a lot of consternation and wasted time for the developer.

- Another aspect of lender education is market or location familiarity. A lender is more willing to lend in their own backyard as they have insights into the local markets, which supports the trend toward regional lenders as a viable option for financing. However, our discussions reveal the basic operational understanding of a waterpark resort is just as important as local market familiarity.

Indoor Waterpark Resort Feasibility Study and Appraisal

- As the foundation for a developer's loan package documentation, a comprehensive feasibility study describes both the physical and economical characteristics of the proposed project. In addition, a well-documented appraisal will analyze construction costs and the market feasibility of the resort in determining the market value. Together, these documents provide the lender with solid information on which to base prudent and informed financing decisions.

- A thorough feasibility study will provide projections of revenues and expenses by outlining industry trends and successes. It will be market specific and realistic in its bottom line NOI projections.

- Projected strong occupancy and ADR performance combined with the most effective revenue streams and accurate development costs do not necessarily make a good deal for a lender. The lender is looking for the borrowing strength of the developer; the operational acumen of the resort and waterpark operator; the strength and cohesiveness of the business and marketing plan; and the personal guarantee of the borrower.

Timing

- Support material and data for an indoor waterpark resort development contained in a feasibility report needs to be current. In 2008 and 2009 a number of projects were put on hold and have been shelved. Like prescription medication, a feasibility study has a shelf life. The shelf life of a feasibility study expires within six to nine months of the study’s initial reporting date. It could even expire sooner, depending upon the market in which the project is located, as well as other external circumstances. If you go to a lender with an outdated report or with piecemeal data, it is inappropriate, and you won’t get far. The shelved feasibility reports need to be updated.

A developer should have a well-organized, professional loan documentation package that communicates all performance aspects and physical characteristics of the proposed resort to the lender in order to educate potential lenders about this area of real estate development.

There are interested lenders who are looking at projects, but developers may have more difficulty finding the right fit for their individual projects. There are relatively few lending institutions actively soliciting these types of projects. However, we anticipate that financing could become somewhat easier as the credit markets thaw, lending institutions become more interested in new development hospitality projects, and the waterpark resort market becomes more prevalent as staycations become more popular.

Conclusion: The financing environment for indoor waterpark resorts remains difficult in 2010 due to a lack of lender interest and larger equity contribution requirements. However, these difficulties can be overcome for a solid project from a creditworthy developer with a well-documented market feasibility study and an appraisal report, which fully explain the market dynamics and income potential for the resort project and serve to educate the lender.

Mr. Sangree is a nationally recognized expert on indoor waterpark resorts and has visited most of the open waterpark properties in the United States and Canada. He has performed more than 200 studies of hotels and resorts with indoor waterparks since 1999, and he maintains a database of statistical information concerning indoor waterpark resorts. Mr. Sangree was named one of Aquatics International Magazine’s “Power 25” in 2008. In their profile Aquatics International named Mr. Sangree as one of the first consultants serving the waterpark resort industry and credited him with shaping some of the latest industry trends through his expertise and experience in the waterpark resort market. Mr. Sangree has appeared on Good Morning America and CNBC on special reports concerning resorts and waterparks.

Mr. Sangree will be speaking at the World Waterpark Association's annual convention and development workshop that will be held in San Antonio the week of October 6 – 9. More information about the convention can be found at the association's website, www.waterparks.org. He can be reached via telephone at 216-228-7000 ext. 20 or via e-mail at dsangree@hladvisors.com.

Eric B. Hansen, AIA, ISHC, is Director of Development Services for Hotel & Leisure Advisors. Mr. Hansen’s expertise is in performing appraisals, market feasibility studies, property condition assessments, project development analysis, and impact studies for hotels, resorts, waterparks, golf courses, conference centers, and other hospitality properties. Mr. Hansen offers 16 years of hospitality experience and has worked throughout the United States providing consulting and architectural services for the hospitality industry. Along with skills in performing consulting reports and designing hospitality properties, he has expertise in performing site planning and development services, planning and zoning expert witness testimony, jurisdictional due diligence, and PIP analysis. He has worked with various major hotel company corporate offices and has extensive knowledge of brand criteria.

He was formally employed by Cole + Russell Architects, Inc. in Cincinnati. Mr. Hansen received his Bachelor of Architecture from the University of Cincinnati in 1989. He became a licensed architect in 1992 and was invited to membership in the International Society of Hospitality Consultants in 2002. He received a certification in Hotel Financial Management from Cornell University School of Hotel Administration, Executive Education program, in 2007.

Hotel & Leisure Advisors (H&LA)

www.hladvisors.com

14805 Detroit Avenue | Suite 420

USA - Cleveland, OH 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Email: dsangree@hladvisors.com

What’s Next for Hospitality in 2026? | By Kate Cheung

Reimagining Space: How Hotels Are Turning Underutilized Areas Into Revenue, Relevance, and Guest Value | By Anthony DiPonio

Immersive Hospitality: Redefining the Guest Experience | By Joseph Pierce