Analysis of Hotel Sales | 2000 - October 2009 | By David J. Sangree, MAI, CPA, ISHC, and Joseph Pierce

Analysis of Hotel Sales | 2000 - October 2009

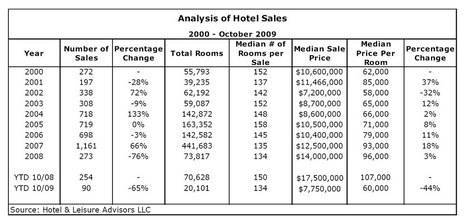

The numbers shown above represent a majority of sales completed in the United States for the years shown. The table illustrates that the number of hotel sales grew from 2001 until 2007. |

Summary: The median sale price per room of hotels in the United States declined by over 40% between year-to-date October 2008 and year-to-date October 2009. The dramatic decline is a result of the economic recession and the fact that there was a much smaller pool of actual sales. The decline indicates the need for property owners and assessors to continually analyze values of hotels in markets throughout the United States which have probably declined since the last valuation by the assessment authorities.

Introduction

Where the bottom is for real estate values continues to be an operative question for owners whether they desire to sell the hotel asset or gain a handle on the worth of their asset. Few markets nationwide have been exempt from the recent decline in property values and many markets have seen a decline of over 40% in just the past two years. Hotel properties that are on the market are taking longer to sell and sale prices are disappointing to many sellers. Although owners and operators have been working diligently to control operating costs, the fixed expenses of taxes and insurance requires careful review as well. The decline in commercial real estate values presents ownership with an opportunity to appeal their property’s assessed value and possibly reduce their tax liability. Assessment authorities also need to be cognizant of the decline in hotel values as they try to maintain proper assessments for their commercial properties.

Hotel Sales Price History

Hotel and Leisure Advisors has been tracking sales of hotel properties that have occurred since 2000. The following table from our database illustrates the hotel sales pattern over the past nine years and year-to-date through October 2009.

2009 Median Hotel Sales Prices Plummet - Is It Time to Appeal Your Property Taxes?

The numbers shown above table represent a majority of sales completed in the United States for the years shown. The table illustrates that the number of hotel sales grew from 2001 until 2007. The dramatic decline in the number of sales in 2008 and again in year-to-date 2009 shows the impact of the current economic recession on the sale of hotels. While the median price per room grew modestly in 2008, it has declined sharply in 2009 as there were fewer sales and they occurred at lower prices. In many instances the current assessments reflect the rise in values which took place earlier this decade. Unfortunately, the assessed value of many properties does not reflect current market conditions. Many assessments have been assigned prior to this precipitous fall and may not be subject to re-assessment until sometime in the future.

Assessed Values of Hotels

The assessed value of real estate is the amount that a government entity assigns to a property on which it wishes to levy taxes. The assessed value of the real estate and the tax rate applied to this value equals the amount of tax each property owner is required to pay. The assessed value should reflect a price which a willing buyer and seller would agree upon. The task of assessing value is an art and not an exact science. Depending upon the jurisdiction, the assessor’s opinion of value is based on the comparison of similar sales (sales approach), relevant cost data (cost approach), and/or the income generating potential of the asset (income approach). The decline in value can result from a number of issues including the decline in prices and market conditions as most markets are currently experiencing, but also results from the volatility in capital markets, condemnation, environmental problems (natural as well as manmade), and numerous other issues that can impact real estate. The assessor’s responsibility is to estimate the fair market value of real estate as of the applicable tax year, so that each property owner pays their fair share of taxes. If the assessed value of the property exceeds the market value for the asset an appeal should be filed.

Any hotel owner who disagrees with the assessed value of their property may file an appeal. However such an appeal requires substantial evidence to support the owner’s real property assessment appeal claim. The appeal should be based upon the development of a well documented appraisal. An experienced hotel appraiser can confirm that the property assessment is in conformity with current appraisal standards and practices and reflects the current market the hotel resides. A well prepared hotel appraisal can provide the support needed to challenge a property tax assessment and refute technical valuation inaccuracies that may be made by the assessor.

Owners and operators of hotel properties become accustomed to paying similar amounts of property taxes annually without realizing that these amounts rise and fall depending upon the property’s assessed value. This requires large portions of their operating budgets to be spent each year to cover property tax liabilities. However, even ownership groups which have not faced large property tax liabilities need to be vigilant regarding their tax assessments. Our firm recently performed an appraisal on a hotel that has benefited from a tax abatement. As the abatement has mitigated the liability, the assessment has been allowed to rise unchallenged. Now, facing the sunset of the abatement, the property is currently assessed at over $13 million while the appraisal yielded a real property value of approximately $6 million excluding personal property and intangible assets. While this example is somewhat extreme, we have come across a number of assignments in which the current appraisal values are well below the assessed value of the hotel and should be appealed. If an owner feels their hotel is overvalued, they have the right to appeal their property tax assessment. The potential savings can be significant, especially for owners that have purchased their hotels after 2006. An important point is that the savings can be ongoing, as the lower value can carry forward benefiting the property with a lower tax liability in future years.

David J. Sangree, MAI, CPA, ISHC is President of Hotel & Leisure Advisors, a national hospitality consulting firm. He performs appraisals, feasibility studies, impact studies, and other consulting reports for hotels, resorts, waterparks, golf courses, amusement parks, conference centers, and other leisure properties. He has performed more than 1,000 hotel studies across the United States and Canada. Since 1987, Mr. Sangree has provided consulting services to banks, hotel companies, developers, management companies, and other parties involved in the lodging sector throughout the United States, Canada, and the Caribbean. He has spoken on various hospitality matters at seminars throughout the United States and on Good Morning America and CNBC. He has written numerous articles for, and is frequently quoted in magazines, television, and newspapers covering the hospitality field. He is a 1984 graduate of Cornell University’s School of Hotel Administration. He can be reached via telephone at 216-228-7000 ext. 20 or via e-mail at dsangree@hladvisors.com.

Hotel & Leisure Advisors (H&LA)

www.hladvisors.com

14805 Detroit Avenue | Suite 420

USA - Cleveland, OH 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Email: dsangree@hladvisors.com

What’s Next for Hospitality in 2026? | By Kate Cheung

Reimagining Space: How Hotels Are Turning Underutilized Areas Into Revenue, Relevance, and Guest Value | By Anthony DiPonio

Immersive Hospitality: Redefining the Guest Experience | By Joseph Pierce