What Are the Risk Factors of a Hotel Waterpark Investment? | By Jeff Coy and Bill Haralson

Thinking about investing in hotel waterpark resorts?

Here are the risk factors you need to consider:

Seasonality

- Ordinary hotels, especially resorts, have big gaps in their business from season to season, month to month and weekdays versus weekends. Seasonal properties find it increasingly difficult to pay annual expenses with a short peak season. However, seasonality is no longer a risk factor for hotel waterpark resorts.

- Hotels with indoor waterparks fill rooms almost 100% every weekend and school break all year long. Hotels/resorts with an indoor waterpark extend their peak seasons from 100 days to 365 days.

Weather

- Many times, even in peak season, poor weather will result in trips, vacations and meetings being cancelled. Weather is no longer a risk factor for hotel waterpark resorts. Hotels and resorts with indoor waterparks save the day with a venue that is weather-proof. Indoor waterparks greatly reduce lost business due to weather and helps to preserve those revenues already booked.

Location

- Recreational locations with interstate highway access and within 200 miles of a major metro area are excellent targets for hotel waterpark development. Families are willing to drive 200 miles in the middle of January to spend a weekend at an indoor waterpark, but the highway must be clear of snow and safe to travel. Therefore, interstate access & visibility within 200 miles of a major population center are extremely important.

- Resort destinations are excellent locations for hotel indoor waterparks. Ski resorts, golf resorts, beach & lake resorts and resort conference centers are ideal locations for hotel waterpark investments.

- Urban locations will attract hotel waterpark investment to revive downtowns and convention centers. Urban entertainment centers will become more popular and include hotels with indoor waterparks.

Room occupancy

- Hotels with indoor waterparks consistently sell more room nights than hotels without indoor waterparks. They achieve higher occupancies up to 26 points higher than ordinary hotels. Our research of the haves and the have-nots in Wisconsin Dells over the last several years proves the positive impact of having an indoor waterpark.

- The 18 hotels with indoor waterparks captured 75% of the total hotel market room revenue in 2001, 77% in 2003 and 81% in 2003. The 44 hotels without indoor waterparks split the leftovers. This upward trend begs the question, “How long can you succeed in Wisconsin Dells as a hotel without an indoor waterpark?” The haves are capturing a bigger and bigger market share while the have-nots continue to lose share.

- The hotels with indoor waterparks that run the highest occupancy have a balanced customer mix of business & leisure, group and individual. Waterpark family users contribute to hotel occupancy only when school is out, so other types of customers are needed to run the highest possible occupancy. Individual business travelers are needed during weekdays. Groups are needed during other low occupancy periods.

- So, the smart investor will insist that hotel waterpark resorts design their facilities for business travelers and conference attendees as well as the family market.

Average room rates

- Most hotel waterpark resorts combine the room rate and waterpark admission into a package price that adds substantially to their ADR --- average daily rate. Having an indoor waterpark can add up to $25 per person to the room rate for an upscale hotel or resort. For a party of 6 persons in a suite, that adds a waterpark premium of $150 to the normal room rate. So an upscale resort without an indoor waterpark and suites costing $175 can now charge $325 --- if it has an indoor waterpark. Of course, for smaller hotels, the waterpark impact on the combined ADR is less. The extent of the impact on ADR depends on size and entertainment value.

Indoor waterpark attendance

- Indoor waterpark attendance is a calculation of available rooms, occupancy, customer mix and persons per room/suite. For example, a 300-room waterpark resort running 70% occupancy with a customer mix of 60% individual leisure guests times 6 persons per room could expect waterpark attendance of 275,940 persons annually.

- Most properties limit their waterpark admissions to hotel guests. A few open to the public at certain times using day passes. Opening to the public is a revenue management decision usually announced a day or two in advance of admission. If you decide, as an investor, to open to the public, you will want to over-size your indoor waterpark in the design phase.

Waterpark admission prices

- Just for fun, multiply that attendance number of 275,940 by $25 a head and you can expect to add that $6,898,000 to your room and waterpark revenues. Day guests (non-hotel guests) would typically pay $30 per person for admission to the waterpark. Two of the largest hotel waterpark resorts that open to the public are charging $39 per person for admission. Capacity is limited so as not to create long lines for the hotel guests who are paying top dollar for their room and waterpark packages.

Revenues

- Having an indoor waterpark can add up to 26 points of occupancy and up to $150 to the price of a room/suite. The combined boost in both occupancy and ADR yields an impressive increase in room and waterpark revenues. Plus, there are incremental sales to be captured: snack food, beverages, ice cream, baked goods, gifts and souvenirs.

Expenses

- A typical upscale hotel or resort has departmental expenses that run from 43% to 45% of total revenues. Obviously, the big difference between an ordinary hotel and a hotel waterpark resort is the waterpark itself. While the indoor waterpark generates significantly to total revenues, it also has a few departmental expenses. The smart investor will insist that the hotel/resort create a waterpark department and hire an aquatics director to run it. Waterpark department expenses, such as labor and supplies, run from a low of $15.31 per square foot of waterpark space to a high of $25.51 psf. So, a 300-room hotel waterpark resort with a 50,000 sf indoor waterpark may have waterpark department expenses from $766,000 to $1,276,000 --- compared to a revenue contribution of $6,898,000, using the example above.

- Indoor waterparks do add some incremental expenses to a hotel’s unallocated expenses --- such as administration, marketing, energy, maintenance and insurance. However, Indoor waterparks do not add significant dollars to a hotel’s A&G or marketing expenses.

- But, adding an indoor waterpark can generate additional energy expenses from $13.00 to $21.39 per square foot of waterpark --- or from $650,000 to $1,070,000 for a 50,000 sf indoor waterpark. Adding an indoor waterpark to a hotel can generate additional maintenance expenses from $7.64 to $10.18 per square foot of waterpark --- or from $382,000 to $509,000 for a 50,000 sf indoor waterpark. Recent insurance quotes for a hotel waterpark resort are running from a low of $17 per thousand dollars of room revenue to a high of $25.

Profitability

- Income before fixed charges is $12,883 per available room for an average upscale hotel in the USA. Compare this to income of $21,478 for a luxury hotel. Then consider that income is $24,238 per available room for the average resort in America, according to the HOST Report, which compiles hotel industry operating statistics.

- By comparison, income is $33,597 PAR for an upscale hotel waterpark resort, such as Great Wolf Lodges. Hotel waterpark resorts: Are they worth it? We think these numbers answer the question quite well!

How Are Investors Getting Into Hotel Waterpark Resorts?

- In 1994, pioneer Stan Anderson expanded his Polynesian Resort out of cash flow. Commercial banks in Wisconsin were the first to understand hotels with indoor waterparks, as they had loaned money for outdoor waterparks for years. Immediately, hotel indoor waterpark projects were viewed as better investments (cash cows) than their seasonal outdoor attraction counterparts.

-

Todd Nelson, owner of the 728-room Kalahari Resort, raised his first $60 million with help from The Marshall Group of Minneapolis and 120 lenders who contributed half a million each to his project, which he later doubled in size using the same financing technique.

- Since 1997, Great Lakes Companies of Madison WI issued private placement offerings to equity investors that wanted to participate in their Great Wolf Lodges in Wisconsin Dells, Sandusky OH, Traverse City MI, Pocono Mountains PA and Williamsburg VA. In 2004, Great Lakes issued an IPO to fund their future growth as an emerging brand of Great Wolf Lodges.

-

Steve Kircher, whose family owns Boyne Mountain Ski Resort in northwest Michigan, was under construction with his 200-unit Mountain Grand condo hotel, when he stopped to hire consultants to re-assess his situation. He knew he wanted to build a large indoor waterpark and looked for an equity partner to help him build the $70 million project. Randy Dzierzawski, who owned a condo at Boyne, stepped forward with the money. Randy formed New Frontiers Capital LLC to partner with Kircher. New Frontiers also worked with Bank of America and Wells Fargo to complete the deal. In May 2005, the 88,000 sf Avalanche Bay indoor waterpark and 220-unit Mountain Grand Lodge opened to make Boyne Mountain Michigan’s first year-round weatherproof resort.

- In 2004, Jerry Andres of Eagle Crest Communities, a subsidiary of Oregon-based Jeld-Wen, a prominent manufacturer of door and window products, worked with Leif Nelson of Crescendo Marketing to pre-sell (in one day) 68 condo units at his Silver Mountain Ski Resort in Kellogg, ID. Jeld-Wen owns several resorts in which indoor waterparks and pre-sold condos are important ingredients in the success of their projects.

In the cases of both Boyne Mountain and Silver Mountain, individual investors are getting involved with hotel waterpark resorts through the purchase of hotel rooms that have been condominiumized for sale. In May 2005, condo-hotel projects were a very hot part of the real estate market. The huge baby boomer market, coupled with a dull stock market and low mortgage rates, is investing their money in resort condos, vacation homes and second homes (even third or fourth homes) because real estate appreciation is running very high. Beyond making money, these individual investors like the idea of owning a place within a resort setting, where they can play with their kids and future grandkids.

Condominium hotels are now part of almost every hotel waterpark project. The good news about waterpark resorts is that they generate substantially higher incomes than ordinary lodging. The bad news is that they are expensive to build. The success of a hotel waterpark resort requires a large investment --- not only in the hotel, but also in the indoor waterpark, which can cost $300 per square foot. As a result, many hotel waterpark resorts, such as Great Wolf Lodges, can cost $40 to $55 million excluding the cost of the land. Some developers/investors are not inclined to spend that much, even with favorable financial terms. So, pre-selling hotel suites to individuals as wholly-owned condominium units is an alternative method that is good for both the resort developer and the condo buyer.

What’s the Impact of Condominiumizing the Hotel Rooms?

Several of the larger hotel waterpark resorts in the Wisconsin Dells have pursued this strategy with success. Kalahari Resort & Convention Center, Wilderness Resort, Great Wolf Lodge and the Chula Vista Resort have all developed condominium guest rooms, which were pre-sold prior to construction.

The advantages to the developer are two-fold. First, he generates revenue from the condo sale prior to construction, thereby reducing his equity requirement and getting his construction loan faster. Second, he benefits from a revenue split with the individual condo owner when the condo is rented as a resort suite by hotel management.

The advantages to the individual condominium buyer are also two-fold. By owning a unit, the condo buyer is gaining access to all of the amenities --- restaurants, bars, spas, golf courses and recreation-entertainment facilities --- that are typically associated with a resort. Adding an indoor waterpark to the resort makes the condo purchase much more attractive to families. In addition, the condo owner is buying into an investment.

Condominium buyers are not required to place their unit in the hotel’s rental pool; rather, they may opt not to place their unit in any rental pool, or may opt to use an outside agency to handle their unit’s rental. However, we determined that most condominium buyers choose to place their unit in the resort’s rental pool.

What Is the Cost to Build a Hotel Waterpark Resort?

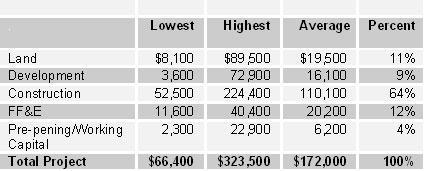

Upscale resort projects in the USA cost from $66,400 to $323,500 per available room to build --- with average being $172,000. For a 300-room resort, that’s a project cost that runs from a low of $19.9 million to an average of $51.6 million.

Costs Per Available Room

The cost of constructing an indoor waterpark building including all FF&E (plumbing, pools, waterslides and play structures) ranges from a low of $167 per square foot of waterpark for spartan-looking economy facilities to a high of $400 per square foot for heavily-themed, state of the art waterparks with “Disney-rocks,” sounds, lights and animation. The variation in cost depends on the size, price tier and entertainment value that the developer wants to achieve. To put costs into perspective, the average is about $300 per square foot for an upscale hotel waterpark resort. There is a direct relationship between the number of guest rooms and the sizing of the indoor waterpark. With 300 rooms, the rule of thumb is 200 sf per guest room to determine the average size indoor waterpark that can be supported by the operation. Obviously, some waterparks are larger and some are smaller in relation to the room count.

A resort hotel considering the addition of 50,000 sf indoor waterpark can expect to add an estimated $15 million to its total project costs. Any investor can feel more comfortable when they know the rationale for sizing and costing the indoor waterpark.

What’s the Return on Investment?

We surveyed a group of upscale hotel waterpark resorts to compare their total project costs with the amount of cash they generated. Due to running higher occupancies, capturing the waterpark premiums and achieving higher levels of spending for food & beverage compared to properties without indoor waterparks, these properties more than offset the cost of building and operating the waterpark. This group of upscale hotel waterpark resorts generated a cash-on-cost return from 14% to 24% --- compared to returns of 10% to 12% for comparable properties without waterparks.

Is there a Market for Updating Older Properties?

Yes, we call it the add a box market. It consists of both new and older properties that could benefit from attaching an indoor waterpark to the hotel.

Every hotel owner and developer will DO SOMETHING with water. Projects will come in all sizes and shapes --- ranging from enclosing the outdoor pool to raising the roof for waterslide towers and adding water play equipment to existing pools. Not all pool enhancements will compete on the resort level. Major indoor waterpark projects will continue to be announced in the top 25 markets, while smaller waterparks will become part of suburban hotels. Projects will be both new construction as well renovation and expansion projects. Older properties are a huge market for small to medium-sized waterpark projects.

Hotel Waterpark Resorts: are they a good investment?

Based the higher occupancies, higher room rates and higher room revenues of hotel waterpark resorts compared to traditional hotels combined with the geometric increase in new construction and development activity each year, it is clear to us that waterpark resorts generate higher returns compared to costs. But that’s our opinion, based on our research.

The investor should conduct his own due diligence to arrive at a totally independent decision. Ask the developer for a copy of his feasibility report. Study the prospectus, public offering and planning documents. Review the financial projections. Understand the source of funds, use of funds and the distribution of funds.

After a review of this information, the investor should be in position to determine whether or not hotel waterparks are a good investment.

Jeff Coy, ISHC

Mobile: 480-488-3382

Email: jeffcoy@jeffcoy.com

JLC Hospitality Consulting, Inc.

www.jeffcoy.com

P.O. Box 4090, 39401 N. 67th Place

USA - Cave Creek, AZ 85327-4090

Phone: (480) 488-3382

9 Hotel Waterpark Resorts Coming to Colorado | By Jeff Coy

Hotels Focus More on Family Fun Facilities | By Jeff Coy