STR Weekly Insights: 11-17 May 2025

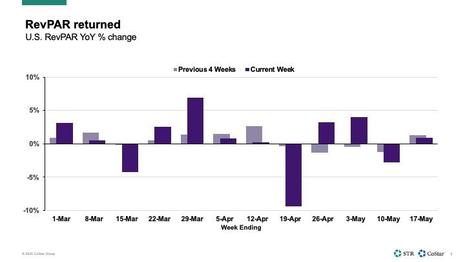

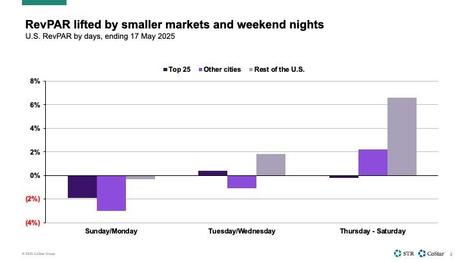

Analysis by Isaac Collazo, Chris KlaudaU.S. hotels posted a modest advance in the week ending 17 May with a strong ending offsetting lackluster performance at the beginning. Revenue per available room (RevPAR) rose 0.9%, lifted by a 1.3% gain in average daily rate (ADR) as occupancy fell. RevPAR on Thursday through Saturday increased 2.4% with Friday on top at +3.3%. Tuesday/Wednesday was flat (+0.4%), and the start of the week was down (-1.7). This is notable because last week, it was the weekend that saw the largest loss. It is difficult to pinpoint the cause of this weekend flip, but it's possible that a shift in high school and college graduations occurred due the later start of the semester after the Christmas/New Year holidays.

Highlights

- Weekend nights and non-Top 25 Markets drove U.S. RevPAR

- Global RevPAR slowed but remained positive

- Mixed signals ahead for summer

Weekends made up for lackluster weekday performance

U.S. hotels posted a modest advance in the week ending 17 May with a strong ending offsetting lackluster performance at the beginning. Revenue per available room (RevPAR) rose 0.9%, lifted by a 1.3% gain in average daily rate (ADR) as occupancy fell. RevPAR on Thursday through Saturday increased 2.4% with Friday on top at +3.3%. Tuesday/Wednesday was flat (+0.4%), and the start of the week was down (-1.7). This is notable because last week, it was the weekend that saw the largest loss. It is difficult to pinpoint the cause of this weekend flip, but it's possible that a shift in high school and college graduations occurred due the later start of the semester after the Christmas/New Year holidays.

Detroit earned top honors during a slow week across the Top 25 Markets

Markets outside the Top 25 drove performance with a 2.2% RevPAR gain, while the Top 25 Markets (T25) dropped 0.4%. However, 11 of the T25 saw RevPAR advance, led by Detroit (+26.1%), which hosted Automate 2025. Chicago saw its RevPAR increase 13.5% with double-digit gains Tuesday through Saturday. All seven submarkets saw RevPAR growth in the week, ranging from +1.4% in Chicago Southwest to +27.6% in Chicago North. The Chicago CBD submarket was up 14.4% for the week and is up 5.9% since 5 January 2025 all on ADR.

Los Angeles and San Diego rounded out the list of double-digit RevPAR gainers. On the flip side, two of the country’s five largest markets, Las Vegas and Atlanta, each saw double-digit RevPAR declines. Atlanta’s slowdown was driven by a decrease in Group demand.

A range of leisure-focused events lifted performance across cities outside the T25

Across the seventy next largest markets, three markets posted notable RevPAR growth - Daytona Beach, which hosted the annual music festival, Welcome To Rockville 2025, as well as Charlotte, with the 2025 PGA Golf Championship, and Tucson, the site of a nature photography conference, NANPA 2025. Overall, only 50 markets outside the T25 saw RevPAR fall for the week, down from 73 in the week before.

College graduations make the grade across smaller markets

RevPAR across several smaller markets were impacted by college graduations from some of the nation’s largest universities. The top three RevPAR markets included Blacksburg (Virginia Tech), Binghamton (Rochester Institute of Technology) and Champaign-Urbana (University of Illinois). All three saw RevPAR increase by more than 100%.

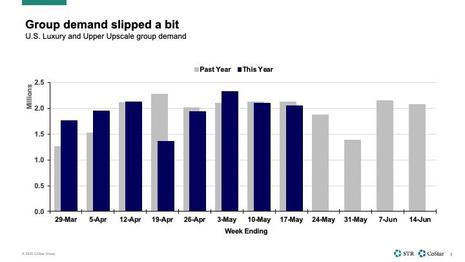

Group demand slipped

Group demand in Luxury and Upper Upscale hotels declined 3.2% with Thursday-Saturday seeing the largest decline, likely impacted by high school and college graduations. Group ADR increased 2.3%, matching transient ADR up 2.4% while Transient demand increased 1.4%. Across the T25, five markets posted healthy group demand led by Detroit, Oahu, Las Vegas, San Diego, and Anaheim (Orange County). Over the past four weeks, Group demand is down in Atlanta, Las Vegas, and New Orleans by more than 10%. Atlanta shows the largest Group demand decline (-15.6%) the last four weeks) but is flat as of May YTD).

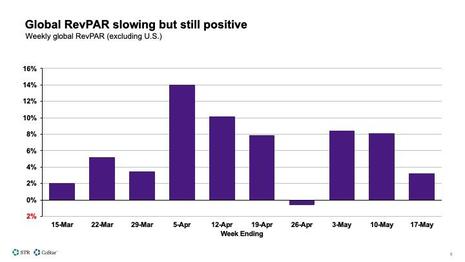

Global RevPAR slowed on falling demand

RevPAR across the globe, excluding the U.S., rose 3.2%. Occupancy retreated 1.2 percentage points (ppts) after two weeks of growth while ADR continued to grow (+4.7%). Global RevPAR has increased 65 of the past 72 weeks and in 18 of 20 weeks this year.

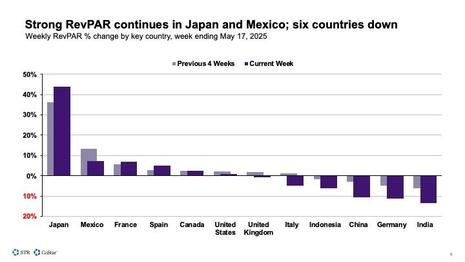

Once again, Japan led among the 12 key countries with RevPAR up 44%, driven by a 44% ADR increase. The country’s occupancy also increased slightly and stood at 79.5%.

Other countries seeing RevPAR gains included Mexico, France, Spain, and Canada. RevPAR was up by more than 5% in those countries, except in Canada where it increased by 2.6%.

China, Germany and India saw RevPAR retreat by more than 10%. China’s decrease was the largest since the week ending 12 April 2025 thanks to falling ADR (-7.1%). Of the 10 largest markets in China, eight saw RevPAR decrease with four noting double-digit declines. While occupancy was down 2ppts for these 10 markets as a whole, demand was somewhat flat (-0.4%) with the occupancy decline more due to increasing supply (+2.4%).

Looking ahead

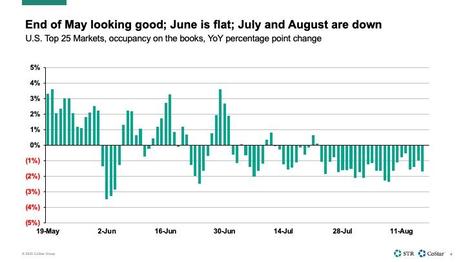

Memorial Day is the unofficial start of summer. Meetings and events along with Transient business travel will slow as is typical during this time of year. There are mixed indicators ahead. Forward bookings are softer for the coming months with bookings positive in May, flat in June and then down for July and August. Shorter booking windows may be creating lower levels for July and August, but we are watching closely.

TSA airport screenings were down this past week, but early indications for next week show improvement. AAA predicts 45.1 million Americans are expected to travel domestically for Memorial Day setting a new weekend record. Thus, only time will tell how people actually react to the increased uncertainty that has permeated this year.

Globally, there are also mixed indicators. Performance has slowed in recent weeks and many of the blockbuster events (Taylor Swift, Euros, Olympics, etc.) from 2024 will provide difficult comps this year in Germany, France, etc. That said, the number of Americans traveling internationally has continued to increase, although this may slow due to the falling dollar. International travel into the U.S. has slowed, which could prove to be a benefit for other regions of the world.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

STR Weekly Insights: 4-10 May 2025

STR Weekly Insights: 18-24 May 2025

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

Asia Pacific hotel performance update - April 2025

U.S. hotel results for week ending 31 May

CoStar, Tourism Economics downgrade U.S. hotel forecast through 2026