U.S. hotel conversion activity remains muted

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

U.S. hotel conversion activity remains muted

|

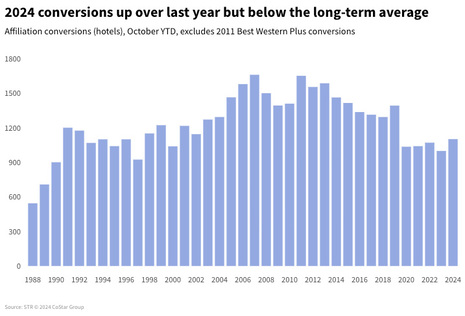

U.S. hotel conversion activity, which involves changing an existing hotel from its independent status, or affiliating it with a new brand; continues to trend below the long-term average of the 20-year period ending 2019. We are benchmarking to this period given that it excludes the disruption in hotel development brought about by the pandemic.

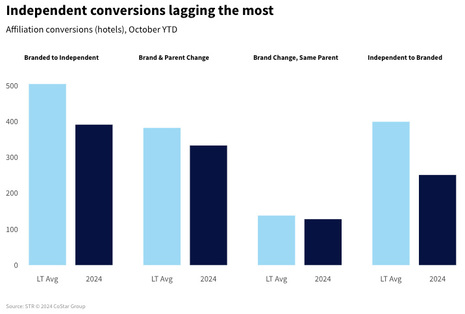

As of October 2024 year to date, 1,103 hotels went through a conversion. That total was up from 1,000 hotels at this time last year but below the 20-year average of 1,424. Of the hotels to make a switch this year, the largest change was with properties that went from branded to independent (391 properties) followed by hotels that have switched to a brand of another parent company (333 properties). Additionally, 251 hotels converted from independent to a brand, while 128 changed brands but remained with the same parent company. Of the total hotels open and operating, 1.7% have changed brands this year as compared to the long-term average of 2.4%.

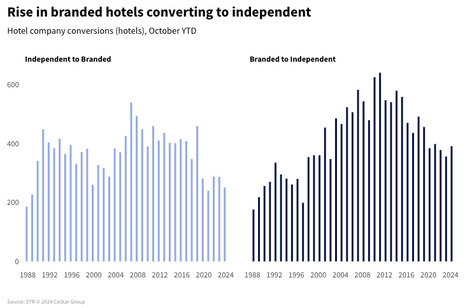

The largest deficit to the long-term average are among hotels converting from a brand to independent and vise-versa. On average over the past three years, 250 less hotels per year have made that change. Prior to the pandemic, an average of 504 hotels converted annually from a brand to independent and another 399 did the opposite, from independent to a brand.

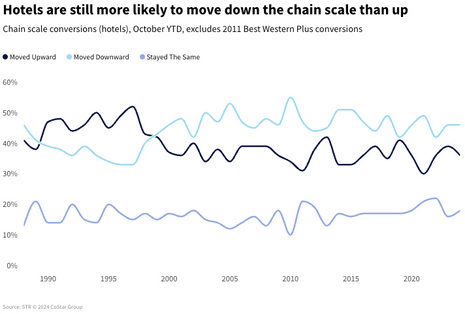

Forty-six percent of the hotels that have changed brands this year went down the scale with 35% becoming independent. However, 36% of hotels moved to a higher chain scale with the largest majority (22%) becoming Economy or Midscale brands, with most formally independent. Only 15% of this year’s conversions are from a lower-tier brand to Upper Midscale or higher affiliation. Furthermore, 18% of hotel conversions remained in the same chain scale. All of these percentages are in line with long-term averages.

Of the hotels that have changed brands in 2024, 23% did so for the first time since their opening with a quarter of those hotels going from a brand to independent. Continuing our review, 19% of the hotels that have converted in 2024 did so for the second time since their opening, with another 18% seeing their third conversion and 17% completing a fourth conversion. Like the percentage of hotels that completed their first conversion, 23% have converted five or more times.

Among hotels that were closed, 307 have reopened this year so far. Of those hotels, the largest number (224) reopened as the same brand with the remainder switching to a different brand or becoming independent.

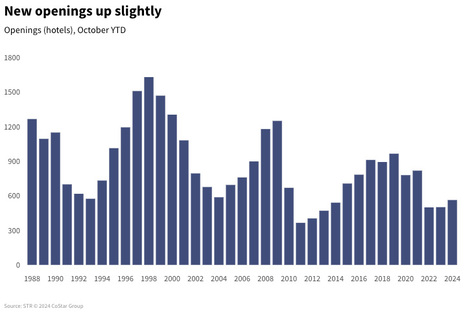

Since the beginning of the year, 564 new hotels have opened, which is the most since 2021 (819) but well below the long-term average (797).

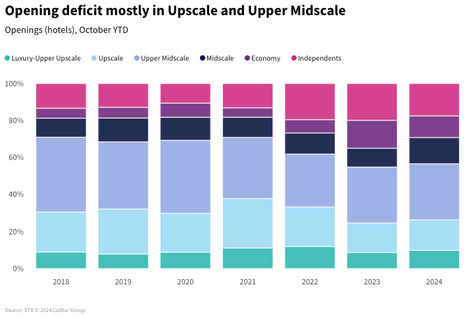

The largest deficit in openings is among the Upper Midscale segment, which still leads openings, accounting for 30% of all new hotels. Independent hotels make up the next largest percentage (18%) followed by Upscale (16%).

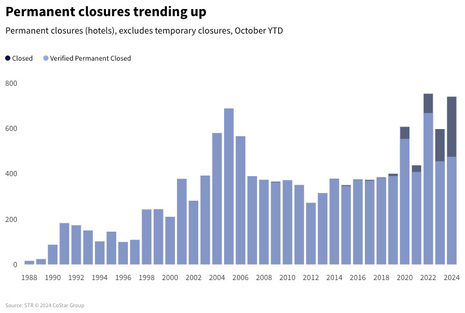

Closures continue to be elevated with 742 hotels closed in 2024. The vast majority (68%) were independent properties with former economy hotels the next largest group (12%). We can verify that 475 of the 742 are permanently closed, while 71 have notified STR that they are closed for renovation, which means that nearly 200 hotels could return to the industry. In any case, the number of 2024 permanent hotel closures is above last year but below what was seen in 2022 (668) and in 2005 (688).

Conversion activity remains relatively muted versus what has been seen in previous years. With new construction held back by higher interest rates and construction costs, we anticipated that more hotels would be converted, especially from the independent stock, but that hasn’t happened. It’s likely that available independent hotels are simply not suitable for conversion either due to age, location or many other factors. Thus, the trend we are seeing of less independent hotels converting to a brand may be the new normal.

*Analysis by Isaac Collazo.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

The end of an Era(s Tour): Taylor Swift’s final impact on hotel performance

U.S. hotel results for week ending 14 December

U.S. hotel performance for November 2024