STR Weekly Insights: 26 October - 2 November 2024

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

STR Weekly Insights: 26 October - 2 November 2024

|

Highlights

- Travel compression, events and recovery efforts again drove U.S. RevPAR

- Southern states led U.S. performance

- Global RevPAR growth remained in double-digits

U.S. posts a fourth week of RevPAR growth

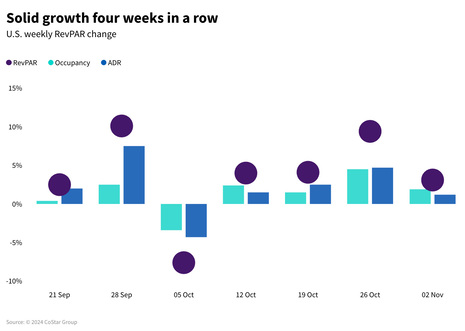

U.S. hotels produced healthy growth in revenue per available room (RevPAR) for a fourth week in a row. The metric was up 3.1% (all comparisons are year-over-year unless otherwise noted) on equal gains in occupancy and average daily rate (ADR). Performance was lifted by the shift of Halloween from Tuesday last year to Thursday this year as well as corporate travel squeezed in ahead of the U.S. election.

These two factors compressed travel for conference/meetings and general business into the start of the week. This is evident as all the growth occurred Sunday through Tuesday with RevPAR rising 38.6%. Thereafter (Wednesday through Saturday), RevPAR declined 13.2%. On Halloween, RevPAR decreased 27.1% on an occupancy level of 53.0%. While the RevPAR decrease this Halloween was slightly more, this year’s occupancy was 1.6 percentage points (ppts) higher. In 2019, when Halloween was also on Thursday, occupancy was almost identical at 53.9%.

Additionally, like in previous weeks, ongoing hurricane recovery efforts, Taylor Swift, and college football games drove demand gains across various markets.

Demand remains elevated in Southern U.S. hotels

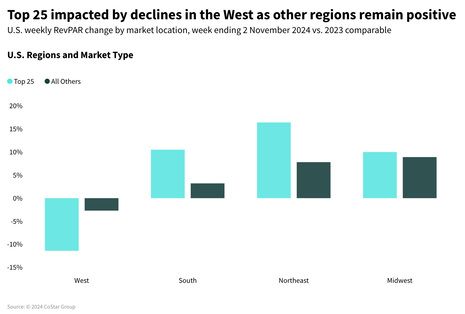

For a second consecutive week, weekly demand was higher than the comparable weeks in 2019 and 2023. More than two-thirds of the week’s demand increase came from markets in the South. The largest demand gainers were in areas impacted by Hurricane Helene and Hurricane Milton, including Augusta, Columbia, Daytona Beach, Florida Central South, Greenville/Spartanburg, Sarasota, and Tampa.

Other events in the region driving demand included the Florida/Georgia football game in Jacksonville and the International Boat Show in Fort Lauderdale, both occurring one week later this year compared to last year providing a favorable comp. New Orleans also benefited from the final performance of Taylor Swift’s Eras Tour in addition to a large conference early in the week.

Demand was also up in the Northeast and Midwest. The Northeast contributed just under one-third of the week’s demand buoyed by strength in New York City (RevPAR: +20.7%) that was capped by the New York City Marathon on Sunday, 3 November. New York continued to lead the nation in occupancy (90.2%) as it has for the past four weeks.

Football games boosted RevPAR performance in smaller Northeast markets including the Pennsylvania Area, which includes State College, home of Penn State University (+63.8% for the week and 144.7% for the weekend), and Buffalo, with RevPAR up 17.5% for the week and 51.6% for the weekend of the Bills’ victory against Miami. Hartford (+25.8%) delivered a solid performance across the whole week.

The Midwest contributed 22% of the demand increase with Minneapolis posting the top spot (RevPAR: +39.5%), impacted by a convention calendar shift, followed by Indianapolis hosting Taylor Swift with RevPAR gains of 27.2% for the week and a whopping 181.1% over the weekend. Indy’s weekend RevPAR of $338 was topped only by New York City ($407).

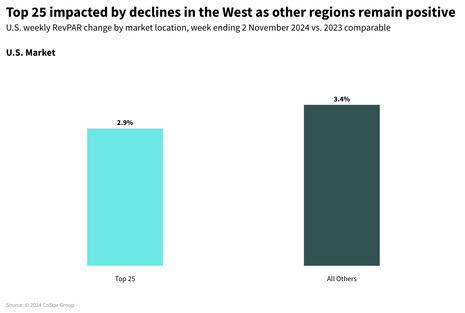

The West region saw demand declines due to soft weeks in Las Vegas and San Francisco with Las Vegas unfavorably impacted by a convention calendar shift. San Diego was the bright spot in the West with a weekly RevPAR gain of 34.2% and the first three days of the week producing RevPAR gains of over 70%.

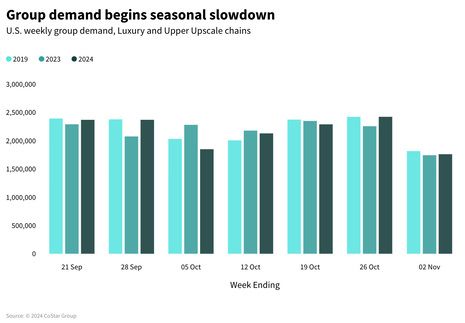

Group demand posts seasonal slowdown

Group demand among Luxury and Upper Upscale hotels slowed, which was expected due to Halloween. Absolute group demand of 1.8 million rooms was up 1% compared to last year while down more than 25% from the prior week’s yearly peak (2.4 million). Group ADR was basically flat at +0.4%. Across the Top 25 Markets, New Orleans, Minneapolis, San Diego and Nashville saw strong group demand with occupancy increases ranging from +4.5 ppts in Nashville to +13.3 ppts in New Orleans. Transient demand among Luxury and Upper Upscale hotels was healthy, increasing 5.2% while ADR slipped slightly (-0.4%).

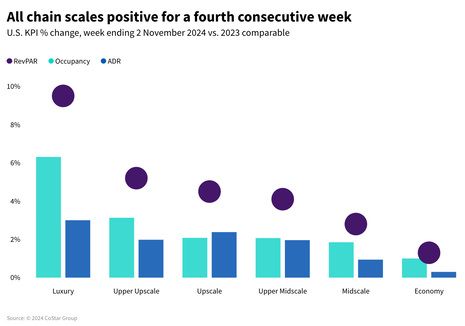

All five chains scales experienced RevPAR growth for a fourth consecutive week with the greatest increase in Luxury (+9.5%) and the smallest increase in Economy (+1.3%). Both occupancy and ADR contributed to the strong RevPAR performance across all chains scales, however occupancy played a more significant role at the top (Luxury) and bottom (Economy).

Global hotels’ sprint continues

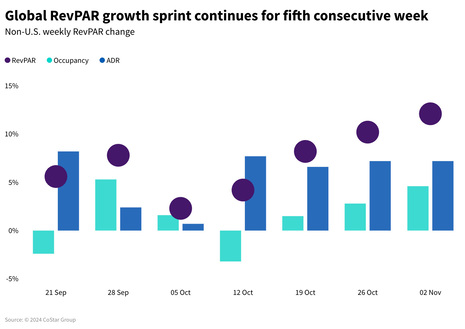

Global RevPAR, excluding the U.S., advanced 12.1%; the second consecutive week of double-digit growth. ADR grew 7.2%, while occupancy increased almost three percentage points to 67.1%. Following a pattern seen in the U.S., the beginning of the week produced the strongest performance, but unlike the U.S., the subsequent days remained positive with Wednesday and Saturday also seeing double-digit RevPAR gains.

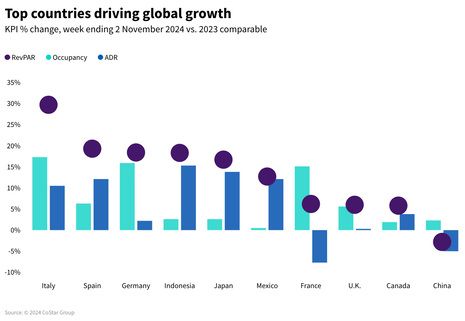

Italy led the top countries in RevPAR growth (+29.7%) as all but one of the 16 Italian markets posted gains, and most markets earned double-digit increases. Spain, Indonesia, Japan and Mexico also posted double-digit RevPAR growth propelled by ADR while Germany’s strong RevPAR showing was lifted almost entirely by occupancy. Gains across these countries was not limited to a few markets but rather in almost all of them.

Room demand in China rose for a third consecutive week and by the largest amount (+4.7%) over that period, but ADR declined 5%, resulting in a retreat in RevPAR (-2.8%). Increasing room demand and declining ADR occurred across most markets in China, including eight of the 10 largest markets based on rooms supply. The two exceptions were Beijing and Guangzhou, where demand was also accompanied by advancing ADR (+0.7% and +2.2%, respectively).

Final Thoughts

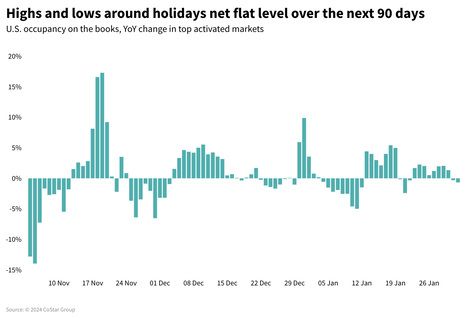

After four weeks of rising RevPAR, we expect that the measure will fall in the week ending 9 November due to the U.S. election. A rebound will then follow, lasting up until the week of Thanksgiving, which occurs later this year compared to last. The final shows of Taylor Swift’s Eras tour will give Canada a boost in Toronto and Vancouver, ending her welcomed contribution this year to the hotel industry and global economy. It remains to been seen if China’s demand growth continues and if it is joined by ADR, which is unlikely given that ADR has fallen in nearly every week this year.

*Analysis by Isaac Collazo, Chris Klauda.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

STR Weekly Insights: 20-26 October 2024

STR Weekly Insights: 3-9 November 2024

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

Hotel pipeline activity increased globally, except in Middle East and Africa

U.S. hotel results for week ending 12 July

U.S. hotel construction fell for sixth consecutive month