Surf Parks Industry Growth and Trends 2024 | By Stephen Szczygiel

Surf Parks Industry Growth and Trends 2024

|

Surf Parks Industry Growth and Trends 2024

|

Surf Parks Industry Growth and Trends 2024

|

Surfing is rapidly gaining traction, emerging as one of the fastest-growing water sports globally. According to the Sports and Fitness Industry Association (SFIA), participation in surfing surged by 28.5% in the United States in 2023, with one in every 100 Americans engaging in the sport (SFIA, 2023). The sport’s global appeal is further bolstered by its inclusion in the Tokyo 2021 Olympics and its confirmed presence in the Paris 2024 and Los Angeles 2028 Games. The Olympic spotlight has significantly increased surfing’s visibility. For example, Brazilian surfer Italo Ferreira, who won the gold medal in Tokyo, saw his social media following grow by 1.3 million, showcasing how elite performances can elevate the sport’s profile and attract new enthusiasts.

This growing interest is favorable for the surf park industry, which is seeing an increase in artificial wave facilities. According to Surf Park Central, the global surf park market is projected to expand at a compound annual growth rate (CAGR) of 11.5% from 2021 to 2028, reaching $3.8 billion by 2028 (Surf Park Central, 2023). This trend presents lucrative opportunities for developers and investors.

New Developments in Surf Parks

Since Hotel & Leisure Advisors’ first surf park study in 2008, the industry has seen significant expansion. The following tables highlight the current inventory of open and planned surf parks around the world.

2024 is set to be a record-breaking year with the opening of nine new wave pools, marking the largest single-year increase in man-made surf parks to date.

Technology Driving Growth

The rise in surf parks can be attributed to advancements in wave-generating technology. Key companies in this sector include:

- American Wave Machines (AWM): Known for its PerfectSwell technology, which creates waves by pumping air into the water. The BSR Surf Resort in Waco, Texas, now known as Waco Surf, was the first public facility using this technology (American Wave Machines, n.d.).

- Kelly Slater Wave Company: Opened a wave pool in Lemoore, California, in 2015, and launched its first commercial facility in Abu Dhabi, UAE, in 2023 (Kelly Slater Wave Company, 2023).

- Endless Surf by Whitewater: Utilizes pneumatic wave-generating chambers and is known for the scalable design of its pools. The O2 SurfTown MUC, set to open near Munich Airport in Summer 2024, will be Europe’s largest wave pool (Endless Surf, n.d.).

- Murphy’s Waves: Designs used globally, including the Wave Palace at Siam Park in Tenerife, Spain (Murphy’s Waves, n.d.).

- Surf Lakes: Upgrading its test facility in Yeppoon, Queensland, Australia (Surf Lakes, n.d.).

- Surf Loch: Known for attractions like FlowBarrel and SurfPool, with its Palm Springs Surf Club being its first commercial surf pool (Surf Loch, n.d.).

- Wavegarden Cove: Operates the most open parks worldwide, with facilities in locations such as Bristol (England), Garopaba (Brazil), and Melbourne (Australia), and plans to open three more locations by 2025 (Wavegarden, n.d.).

Trends for 2024

Several trends are shaping the surf park industry:

- Technology Reliability: Technological advancements are crucial. Issues with surf parks like Surf Snowdonia and Palm Springs Surf Club highlight the importance of reliable wave-generating systems for business success

- Sustainability: A growing emphasis on sustainable practices is evident. Surf Park Central’s 2023 Consumer Trends Report indicates that 90% of surfers prefer parks with sustainable practices, and 92% are willing to pay more for these options (Surf Park Central, 2023). The STOKE (Sustainable Tourism and Outdoors Kit for Evaluation) standard, launched in 2021, is gaining traction as a benchmark for sustainability (STOKE, 2021).

- Mixed-Use Developments: Surf parks are increasingly being integrated into mixed-use developments that include hotels, residential areas, and retail spaces. This approach enhances their appeal and revenue potential by creating multifaceted attraction.

- Institutional Investment: There is growing interest from institutional investors and real estate investment trusts (REITs) in surf parks. These projects typically require significant investment, ranging from $40 million to over $350 million, highlighting the need for adaptable business models and thorough feasibility studies.

- Accessibility and Diversity: Surf parks are becoming more inclusive, offering programs for surfers of all abilities and backgrounds. The International Surfing Association’s World Para Surfing Championship and recent demographic shifts in surfing highlight the sport’s increasing diversity (ISA, 2021; SIMA, 2024).

Pricing and Attendance

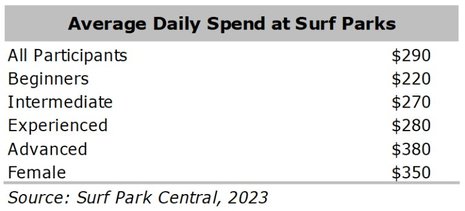

The success of a surf park development is dependent on its revenue stream. The following table shows the average daily spend at surf parks in 2022 with beginners spending less, while advanced surfers and women spent considerably more.

Hourly session prices typically range from $60 to $160 for beginner to advanced. While surf sessions are the item most purchased by surf park visitors, there are many other revenue streams available to surf park operators, such as food & beverage, rentals, and lodging. Average dwell time across all surf park visitors is in the three- to four-hour range, though there are very significant differences among surf parks.

The pools usually are capacity controlled, with a limited number of people allowed at one time, depending on the size of the surfing pool and the technology utilized. Additionally, depending on location, some surf parks can operate year-round while others need to close or limit their hours during winter months. Surf parks’ attendance consequently shows a very wide range, our research indicating from 50,000 to 250,000 visitors a year.

Conclusion

In 2024, the surf park industry is experiencing a surge in innovation, driven by advancements in technology and a growing demand for accessible wave experiences. Newer facilities are incorporating sophisticated wave generation systems that mimic natural surf conditions more accurately, providing riders with a range of wave sizes and styles suitable for all skill levels. Additionally, the integration of eco-friendly practices is becoming more prevalent, with many surf parks focusing on sustainability by utilizing renewable energy sources, efficient water management systems, and environmentally conscious construction materials. These advancements not only enhance the surfing experience but also align with the broader trend of environmental stewardship within the industry.

Looking ahead, the surf park industry is likely to see increased diversification and expansion, both in terms of geographic reach and the range of activities offered. As more regions around the world develop surf parks, there will be a greater emphasis on creating unique, localized experiences that cater to the specific preferences and cultural aspects of each area. Beyond traditional surfing, many parks are exploring additional features such as integrated fitness centers, lodging, surf schools, and wellness retreats to create a comprehensive recreational destination. This trend towards diversification is expected to attract a wider audience, from surf enthusiasts to families seeking a multifaceted leisure experience, further solidifying the surf park’s place as a major player in the global leisure and sports market.

Hotel & Leisure Advisors (H&LA)

www.hladvisors.com

14805 Detroit Avenue | Suite 420

USA - Cleveland, OH 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Email: dsangree@hladvisors.com

What’s Next for Hospitality in 2026? | By Kate Cheung

Reimagining Space: How Hotels Are Turning Underutilized Areas Into Revenue, Relevance, and Guest Value | By Anthony DiPonio

Immersive Hospitality: Redefining the Guest Experience | By Joseph Pierce