PwC Manhattan Lodging Index: Q2 2024

PwC Manhattan Lodging Index: Q2 2024

|

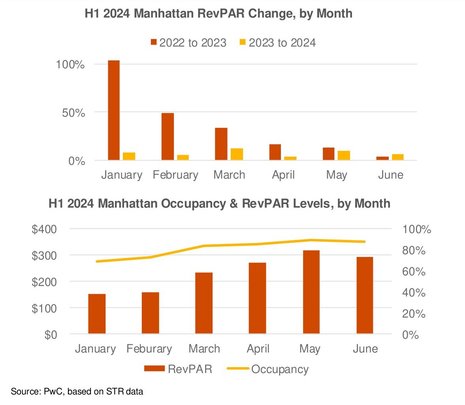

The rate of growth in occupancy, average daily rate (“ADR”) and revenue per available room (“RevPAR”), while robust, continued to decelerate. Luxury hotel occupancy benefitted from increased demand, while ADR growth levels for lower priced properties continued to show significant improvements. For the overall Manhattan hotel market, Q1 RevPAR increased 9.4 percent while Q2 increased 6.8 percent, from the same respective periods in 2023.

RevPAR increased 6.8 percent year-over-year during the second quarter of 2024. Occupancy and ADR continued to advance, albeit at a slower pace than Q1. Q2 annual increases in occupancy were highest in May – up 5.2 percent, and lowest in April – up 2.9 percent. Q2 2024 average occupancy and ADR increased to 87.2 percent and $336.84, respectively, resulting in Manhattan RevPAR jumping to $293.62 from $274.89 in Q2 2023.

The Manhattan hotel market averaged an occupancy level of 87.2 percent in Q2 2024, solidifying a return to stabilized pre-covid levels. While RevPAR growth decelerated significantly throughout the first half of 2024, minimal hotel room supply additions over the next several years are expected to benefit existing hotels, potentially resulting in price compression in the market. Abhishek Jain, Principal, PwC

Of the four market classes tracked, luxury properties exhibited the most significant year-over-year increase in RevPAR - up 8.3 percent for the quarter, driven by a 6.3 percent increase in occupancy from 76.2 percent in Q2 2023 to 81.0 percent in Q2 2024 and a 1.8 percent increase in ADR from $535.97 to $545.79.

For upscale properties, quarterly occupancy grew by 2.4 percent and ADR by 3.2 percent year-over-year, resulting in a RevPAR increase of 5.7 percent from Q2 2023. Upper upscale properties experienced a 7.2 percent increase in RevPAR since Q2 2023, driven by a 4.1 percent increase in occupancy and a 3.0 percent increase in ADR. Upper midscale properties posted a 6.6 percent increase in RevPAR year-over-year, attributable to an increase in occupancy of 2 percent and an increase in ADR of 4.5 percent. All four market classes saw RevPAR increase by at least 5 percent since Q2 2023, driven by increases in occupancy and ADR across all classes.

| Adobe PDF Document (Download Acrobat Reader) Created: 27 August 2024 | File Size: 845 Kb |

PwC

https://www.pwc.com/gx/en/industries/hospitality-leisure.html

300 Madison Avenue 26th Floor

USA - New York, NY 10017

Phone: (646) 471-5706

Fax: (646) 471-8869

PwC: UK Hotels Forecast 2024 - 2025

PwC: Tech the halls: How digital experience shoppers are shaping retail

PwC: Post-election clarity and ADR increases likely to sustain hotel performance through 2025 amid modest demand growth