Measuring Economic Impact Is a Win-Win for Developers and Municipalities | By David Sangree

Measuring Economic Impact Is a Win-Win for Developers and Municipalities

|

Measuring Economic Impact Is a Win-Win for Developers and Municipalities

|

Measuring Economic Impact Is a Win-Win for Developers and Municipalities

|

Introduction: At a time when financing for hospitality development projects is challenging for developers, it can often mean that some projects won’t ever come to fruition. At the same time, municipalities would like to increase their hotel or resort offerings to attract travelers to their destinations while remaining fiscally responsible. When developers seek government assistance for development projects, state and local authorities must balance the needs of developers in the community with the financial realities of the project. Commissioning an economic impact study will provide important data for stakeholders to understand the economic benefits of a project and assess its desirability and its overall economic impact on the local or regional economy. The case study presented in this report shows the occupancy impact that Kalahari Resorts has caused in the markets where they have been developed in Ohio, Pennsylvania, and Texas over the past 20 years. The statistical data shows strong positive growth in market occupancy levels caused by the addition of these themed resorts with high room counts and multiple attractions. An economic impact study can similarly provide developers and government representatives with financial information to forecast the economic impact of a proposed development.

PURPOSE OF ECONOMIC IMPACT STUDY

An economic impact study estimates the total benefits of a project, including tax revenues, employment changes, additional spending impacts during the construction and operational phases, revenues from increased commercial activity and tourism, and other changes in the community. It will also measure the impact on other local businesses in the area that may benefit from a new hospitality property. The results of this study are often used to calculate financial incentives that municipalities are willing to offer a development project based on the projected impact on the local economy. In addition, the study can also be used to demonstrate benefits that may persuade communities to support a project.

Resources: H&LA utilizes the following resources when preparing economic impact studies:

- Financial projections for the proposed resort or attraction. These are typically prepared by our firm but we can also consider projections prepared by the developer and other consultants.

- Employment and wage data supplied by the U.S. Department of Labor.

- The Regional Input-Output Modeling System II (RIMS II) generated by the U.S. Department of Commerce’s Bureau of Economic Analysis provides multipliers for output, earnings, and employment by industry aggregation for every county in the United States. There are similar multipliers provided in other countries.

- Visitor spending statistics for the local market, including information by tourism research firms such as Tourism Economics, Dean Runyan Associates, or Longwoods International.

Methodology: The economic impact can be broken down into two phases: short-term (construction) and long-term (operation). Both phases generate income, employment, and taxes in the affected region. The local community is generally most concerned about the additional employment and revenues a new development will bring to the area, while the governmental officials are generally most concerned about the anticipated fiscal (tax) impacts. Economic impacts are generally measured on three levels:

- Direct-Effect Impact, which includes the jobs and spending directly created by the construction and operations of the hospitality development

- Indirect or Induced Impact, which results from production changes in downstream industries associated with the initial direct spending and employment at the facility.

- Final Impact, which represents the overall economic impact of a change in final demand on output, earnings, and employment on a region’s economy. The final impact calculations represent the increased output, earnings, and employment that occur in an economy because of spending caused by the proposed development.

Final Impact = Direct-Effect Impact + Indirect or Induced Impacts

The multiplier concept recognizes that income is spent in successive rounds within the community and that these chain reactions create an economic impact greater than the original expenditure and employment levels. For example, each dollar collected by the proposed resort will eventually recycle or multiply itself, creating many levels of economic activity in an area. As a prospective employer, a resort pays wages, and these wage earners in turn make purchases from local businesses. As taxpayers, all businesses and individuals benefiting from or adding incremental revenue to the economy also confer revenue to the community in terms of taxes. As a consumer, the proposed resort would buy goods and services from area businesses. Hence, the multiplier concept represents multilevel economic activity.

The multiplier effect is directly related to a region’s geographic size, population, and the diversity of its industrial and commercial base. Densely populated areas are generally able to support a more diverse economic base, and more products are likely to be manufactured and purchased locally rather than imported. Therefore, money injected into the economy is more often spent locally, causing greater changes in local business volume. The multiplier effects may be somewhat limited in that a portion of the impact might be directed to areas outside the county. For example, it is likely that the furniture, fixtures, and equipment for a resort will be manufactured and shipped from areas outside of the county where it will be constructed.

TYPES OF ECONOMIC IMPACT TO ANALYZE

There are multiple types of impact to analyze in an economic impact study. The following highlights major components to consider.

- Construction Impacts: Any hospitality property creates impact from its construction. The economic impact study should incorporate the development budget for the project, which represents a one-time activity, expected to occur over approximately a two-year period.

- Operations Impact: After construction, the resort or attraction will then open in the market, creating additional impact due to its operation in terms of employment, goods and services, and additional impacts.

- Visitor Spending Outside of Resort: The proposed resort or attraction will also have an impact on the economy of the surrounding area as a result of the increase in visitors and visitor spending. The proposed resort is projected to draw new visitors to the area. Our calculations of economic impact in this area are tied directly to the number of projected visitors. Economic impact results from the import of new dollars from spending primarily by nonresidents in the local economy. The extent to which visitor dollars are retained locally depends on the types of establishments that visitors utilize.

- Impacts on Existing Businesses: Local businesses will be impacted by the development and operation of the proposed project and those impacts, often to other local hotel, restaurant, and attraction properties, can be measured in terms of changes in occupancy, ADR, and revenue levels.

CASE STUDY IN ECONOMIC IMPACT

To demonstrate one aspect of what an economic impact study can measure, we highlighted recent research we have conducted concerning the impact of three Kalahari resort developments on their respective communities of Sandusky, Ohio; Pocono Manor, Pennsylvania; and Round Rock, Texas. While these resorts had measurable impacts on employment, spending, and taxes in their respective communities, this analysis shows the economic impact of these developments on the surrounding hotels in terms of occupancy points. It is important to note that the occupancy impact on surrounding hotels is only one metric of many that an economic impact study considers.

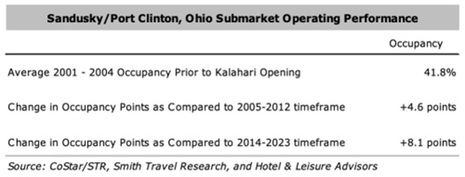

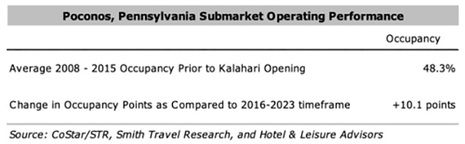

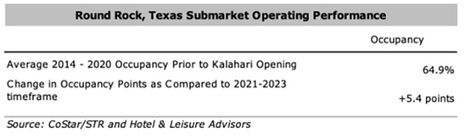

Impact on Area Hotels: Over the past two decades, Kalahari Resorts has opened large-scale indoor waterpark resorts in Sandusky, Ohio; the Pocono Mountains area of Pennsylvania; and Round Rock, Texas, just outside of Austin. The addition of any new property, particularly one with a high room count, has the potential to lower occupancy rates and hamper overall profitability within the local market. However, as the following tables illustrate, the areas surrounding these properties achieved improved occupancy performance in the years following the opening of the respective Kalahari Resorts properties.

Kalahari Resorts & Conventions – Sandusky opened in May 2005 as a 308-room resort with indoor and outdoor waterparks. It now features 890 rentable units, including 284 guestrooms, 192 three-key condominium units yielding 576 keys, and six 5-bedroom Nyumba Entertainment Villas. In 2023, the resort added a 15,000-square-foot outdoor pool and outdoor adventure park attractions.

In the years prior to Kalahari’s opening, occupancy rates in the Sandusky/Port Clinton hotel submarket ranged from about 38% to 45%. After 2005, occupancy rates increased gradually, hovering at about 50% by the mid-to-late 2010s. Following the disruption caused by the COVID-19 pandemic in 2020, the submarket’s occupancy rate returned to over 50% in 2021 and has averaged about 55% over the past three years. As shown, the introduction of the Kalahari Resort Sandusky has boosted overall market occupancy rates in the first decade after its opening by 4.6 points and more particularly in the second decade after opening by 8.1 points. The development of this large-scale resort has boosted the tourism economy in Sandusky and caused extensive related development in Erie County, Ohio.

Kalahari Resorts & Conventions – Poconos is in the Pocono Mountains region of Pennsylvania. The first phase of the resort opened in June 2015 and featured 457 rooms, a 106,000-square-foot indoor waterpark with a retractable roof, and an outdoor waterpark. A second phase opened in March 2017 and included 520 guestrooms, 114,000 square feet of additional indoor waterpark space, food and beverage outlets, and outdoor activities. In 2019, the property expanded their meeting and convention space. It now offers 977 rooms, 12 food & beverage options, 112,954 square feet of meeting space, and a 220,000-square-foot indoor waterpark.

In the years leading up to Kalahari Resort’s opening, occupancy rates in the Poconos & Stroudsburg hotel submarket ranged from about 45% to 52%. By 2019, the submarket’s occupancy had risen to almost 65%. In the years since the pandemic, the area has seen occupancy rates level off at around 60%, with an ADR of well over $200. The development of the Kalahari Resort has increased the appeal of the Poconos as a vacation destination and benefited all hotels within the market causing economic impact to a wide range of businesses.

Kalahari Resorts & Conventions – Round Rock opened in November 2020. The facility offers 975 rooms, a 223,000-square-foot indoor waterpark, the 80,000-square-foot Tom Foolery’s Adventure Park, 10,000 square feet of retail space, a 121,701-square-foot convention center, 11 food & beverage outlets, event barn, and a multi-acre outdoor waterpark. In 2023, the property expanded their outdoor waterpark with a new adventure river, outdoor pools, and water slides.

In the years leading up to 2020, occupancy rates in the Round Rock/Georgetown hotel submarket held at around 66% to 68%. Hotel performance in the Round Rock/Georgetown area recovered quickly after 2020, with occupancy returning to pre-pandemic levels in 2021 and 2022, then topping 70% in 2023. Hotel performance statistics in the Round Rock/Georgetown submarket have shown growth since the opening of the Kalahari Resort property. The market grew by 5.4 occupancy points when comparing the average of 2014 to 2020 to 2021 to 2023 timeframes. The local hotel market experienced gains in occupancy despite the addition of 975 rooms at the Kalahari Resort, indicating economic impact has been achieved in the short timeframe since they opened.

MUNICIPAL INCENTIVES

As a result of the economic impact that a hospitality project will have on a city or region, many cities have provided incentives for larger resort and waterpark projects through tax abatements, tax incremental financing districts (TIF), infrastructure support, marketing support, and tax credits or rebates. There have been numerous projects throughout the United States that have received municipal funding based on the projected economic impact. We have highlighted several to show the different types of incentives that can be available to developers of hospitality projects.

- Slated to open in 2026, the 900-room $885 million Kalahari Resort in Thornburg, Virginia, will receive tax incentives that include rebates on sales, food and beverage, bed, and admissions taxes. The government will also provide grants related to tangible personal property; business, professional, and occupational licenses; permit fees; and water and sewer fees. The grants are intended to incentivize the investments associated with Kalahari Resort as measured by the taxes. The company is required to make capital investments of at least $475 million prior to June 30, 2029. The board also approved a separate performance agreement allowing Kalahari Resorts to obtain financing through Virginia’s Tourism Development Financing Program under which Spotsylvania County and the state will contribute future sales tax revenues towards Kalahari’s debt with their lender. The county’s contribution is estimated at $74.8 million.

- The Town of Perryville and Cecil County, Maryland, jointly approved a 25-year tax incentive deal to bring a Great Wolf Lodge resort to the area. Great Wolf Resorts projected that the resort would generate 850 new jobs. The incentives are valued at $91.8 million in contributions, performance-based tax credits, grants, and fee reductions, the largest share coming from Perryville’s 6% hotel tax. Great Wolf Lodge will be reimbursed for 97.5% of the hotel tax in the first 10 years and for 95% in the following 15 years, totaling nearly $65 million. Additionally, Perryville provided infrastructure upgrades. Despite these incentives, the city anticipates a net gain of $18 million in tax revenues from personal property tax, hotel tax, and multiplier effect tax revenues as a result of the project.

- The 975-key Kalahari Indoor Waterpark Resort Round Rock, Texas, opened in November 2020. The City of Round Rock approved an incentive package for the resort in December 2016. The City built the $40 million convention center that was leased to Kalahari Resort, invested $30 million in bonded funds for public improvements, and purchased 351 acres for $27.5 million to lease to Kalahari Resort for 99 years. Kalahari Resorts will have the option to buy the land for $1/acre at the end of 99 years. Kalahari Resorts made an initial lease payment of $17 million while the city contributed $10.5 million. Kalahari Resorts will make a second lease payment of $10.5 million plus interest in eight years.

- Great Wolf Lodge constructed a 456-room indoor waterpark resort in LaGrange, Georgia, which opened in 2018. In October 2015, Great Wolf Lodge signed an agreement with the County Commission, Board of Education, Town Council, and Development Authority of LaGrange to invest at least $150 million in private equity for the development. The Development Authority of LaGrange approved a $170 million bond issue for the development that is backed by Great Wolf Lodge. The Town of LaGrange will own and finance the adjoining conference center using a $17 million taxpayer-backed bond. The Town is expected to lease the conference center to Great Wolf Lodge for $10 per year for a period of no more than 50 years. The occupancy taxes from the resort will be used to repay the taxpayer-backed bond. Additionally, 31.25% of occupancy tax revenues will be used to finance marketing of the resort and the LaGrange market. A 15-year property tax abatement has been approved for the development and will not affect school board revenues. Great Wolf Lodge will pay 10% of the assessed property value taxes in year one, after which it will increase by 5% every year until the end of the 15-year period.

CONCLUSION

Municipalities are looking for opportunities to support hotel, resort, or attraction development that will bring additional visitors and economic impact to their areas. This makes the economic impact study a vital tool for policymakers, developers, hotel companies, city and county officials, state tourism departments, and convention and visitors bureaus to quantify the potential economic benefits that may be realized from the development of a new hospitality or attraction project. The economic impact study provides financial projections to justify whether providing financial incentives to a hospitality development is justified.

Hotel & Leisure Advisors (H&LA)

www.hladvisors.com

14805 Detroit Avenue | Suite 420

USA - Cleveland, OH 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Email: dsangree@hladvisors.com

What’s Next for Hospitality in 2026? | By Kate Cheung

Reimagining Space: How Hotels Are Turning Underutilized Areas Into Revenue, Relevance, and Guest Value | By Anthony DiPonio

Immersive Hospitality: Redefining the Guest Experience | By Joseph Pierce