2023 European Hotel Transactions | By Matthias Hecht

2023 European Hotel Transactions (source: HVS – London Office)

|

2023 European Hotel Transactions

Chart 1: Total Assets Average Price Per Room 2015-23 (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 2: Total Hotel Investment Volume 2006-23 (source: HVS – London Office) |

2023 European Hotel Transactions

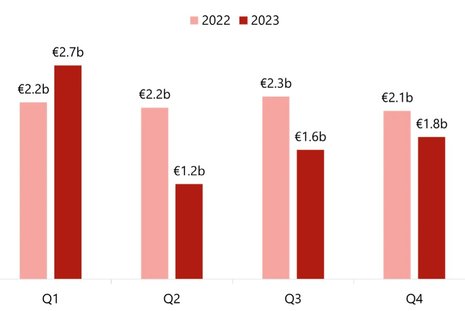

Chart 3: Total Asset Quarterly Volume 2023 Vs 2022 (source: HVS – London Office) |

2023 European Hotel Transactions

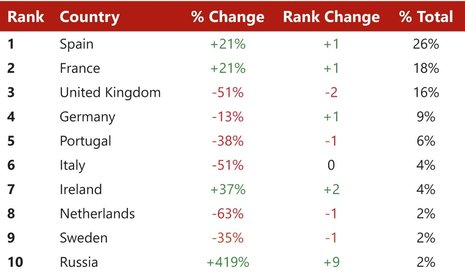

Chart 4: Top Countries – Total Asset Activity By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 4: Top Countries – Total Asset Activity By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 5: Top Cities – Total Asset Activity By Volume (source: HVS – London Office) |

2023 European Hotel Transactions

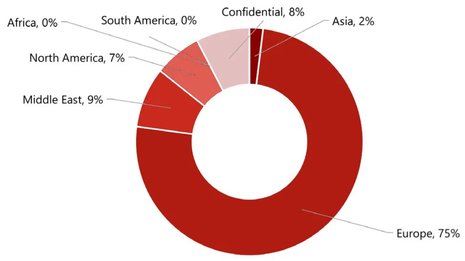

Chart 6: Total Deal Activity By Investor Source Region (source: HVS – London Office) |

2023 European Hotel Transactions

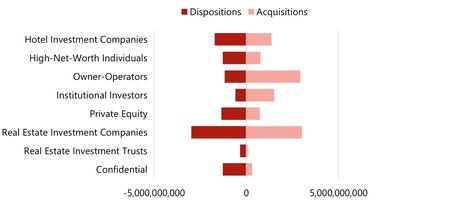

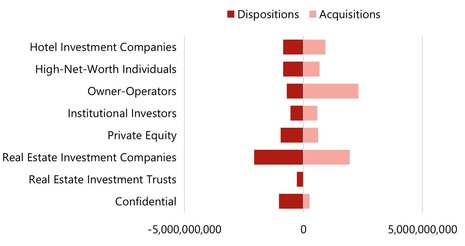

Chart 7: Capital Flows By Investor Type (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

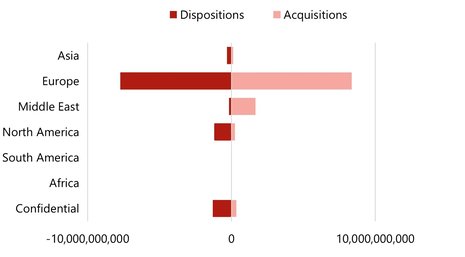

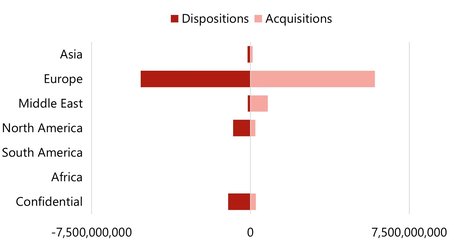

Chart 8: Capital Flows By Investor Source Region (¤) (source: HVS – London Office) |

2023 European Hotel Transactions (source: hvs)

|

2023 European Hotel Transactions

Chart 9: Single Asset Top Countries Breakdown By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 9: Single Asset Top Countries Breakdown By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

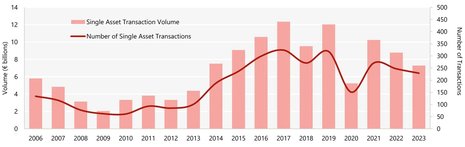

Chart 10: Single Asset Investment Volumes 2006-2023 (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 11: Single Asset Transaction Volume By Quarter 2023 vs 2022 (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 12: Single Assets – Capital Flows By Investor Type (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 13: Single Assets – Capital Flows By Investor Source Region (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

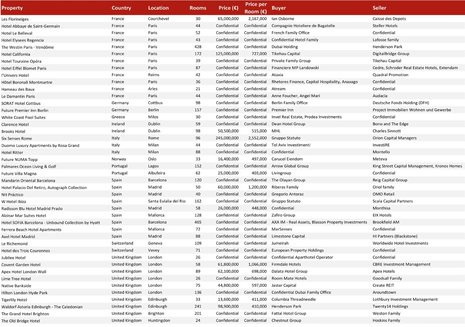

Chart 14: Notable Single-Asset Transactions (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

|

2023 European Hotel Transactions

Chart 15: Portfolio Transaction Volume By Quarter 2023 vs 2022 (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 16: Portfolio Investment Volumes 2006-2023 (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 17: Portfolio – Top Countries Breakdown By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 17: Portfolio – Top Countries Breakdown By Volume (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

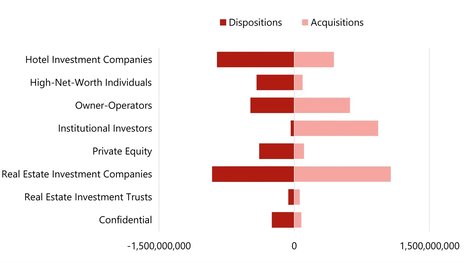

Chart 18: Portfolios – Capital Flows By Investor Type (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

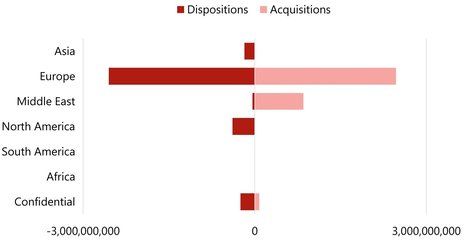

Chart 19: Portfolios – Capital Flows By Investor Source Region (¤) (source: HVS – London Office) |

2023 European Hotel Transactions

Chart 20: Portfolio Transactions (¤) (source: HVS – London Office) |

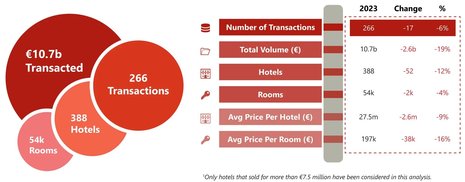

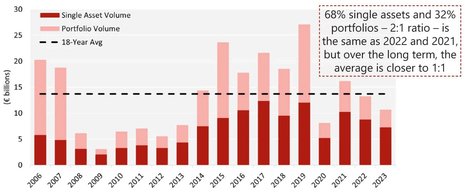

High inflation and consequential rises in interest rates had major impacts on investment markets throughout 2023, including slowed hotel transaction activity in Europe. Reaching ¤10.7 billion overall[1] , total volume was 19% lower than in 2022, which represented the second lowest level of investment in the last decade. There were 6% fewer transactions than in 2022, indicating that the average price per room was also down in 2023.

Total Transaction Volume

Pricing & Deal Size

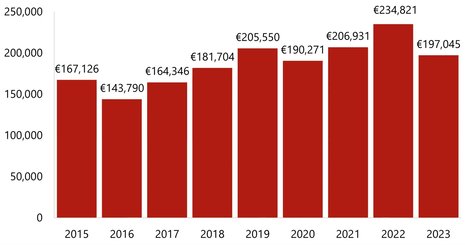

- The average price per room was ¤197,000 in 2023, a decrease of 16% over 2022 and around 5% lower than in 2021 and 2019;

- Hotels in 2023 transacted for an average price per hotel of ¤27,500,000 (a 9% decrease over 2022) and had an average of 140 rooms (a 9% increase over 2022).

Seasonality

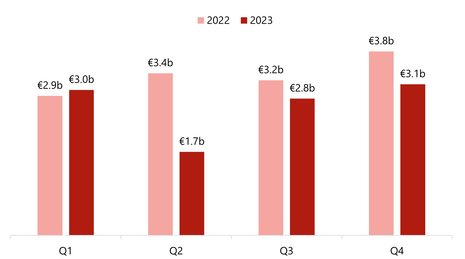

- As is often the case, transaction volume was higher in the second half of the year in 2023. The fourth quarter recorded the highest level of activity (although being only 3% ahead of Q1 and 10% ahead of Q3);

- Q1 2023 was the only quarter to experience an increase in transaction volume over 2022 (a 4% increase), and Q2 2023 was 50% less than Q2 2022.

Activity by Investor Type

- As in 2022, Real Estate Investment Companies were the most active investors in 2023, buying and selling nearly ¤6 billion in assets (although that being a 28% decrease from 2022), followed by Owner-Operators that transacted a combined ¤4.1 billion of properties (a 45% increase over 2022);

- After being the second most active transactors in 2022, Private Equity investors were only the fifth most active group in 2023;

- Owner-Operators were the largest net buyers in 2023 with a positive balance of ¤1.7 billion, followed by Institutional Investors at ¤930 million. The largest net sellers were Private Equity companies with a negative balance of ¤628 million, closely followed by High-Net-Worth Individuals at ¤507 million.

Single Assets

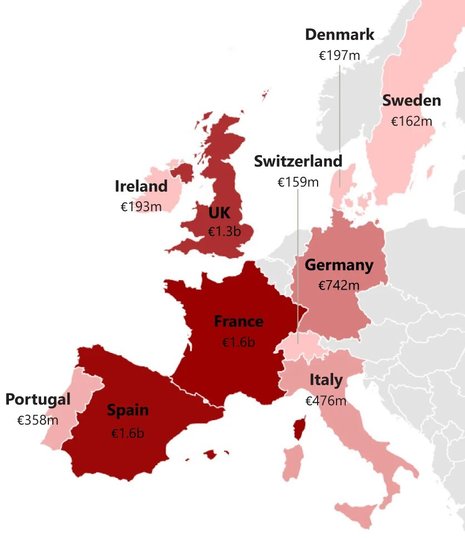

Single asset transaction activity declined in 2023, as a significant number of investors awaited either a decrease in interest rates or a reduction in pricing (despite increasing top-line hotel performance) to better reflect their perception of values given the higher cost of funding.

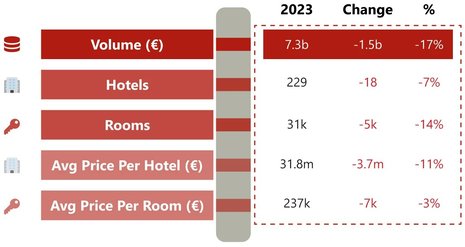

Volume

- Single asset transaction volume in 2023 totalled ¤7.3 billion, which was 17% less than 2022 volumes and 39% below 2019, and was again the second lowest level since 2013. Majority of the activity took place in H1 2023;

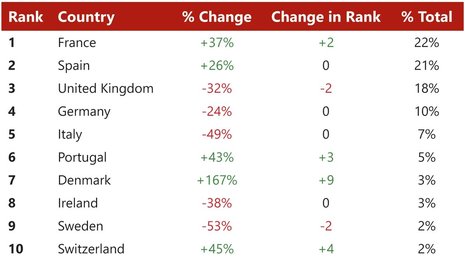

- France was Europe’s most liquid single asset market in 2023, with 37% more activity than in 2022, moving up two places and dethroning the United Kingdom, which accounted for only 18% of all single asset transactions in 2023 compared to 22% in 2022. Spain remained in second place for the fourth consecutive year, with Germany and Italy remaining in fourth and fifth positions respectively;

- Other markets besides France and Spain that saw increased single asset activity in 2023 were Portugal (+43% and up to sixth), Denmark (+167% and up to seventh) and Switzerland (+45% and up to tenth).

Cities

Certain major European cities attracted larger investments than they did in 2022, and noticeably contributed to their respective country’s 2023 growth.

- Paris topped the city rankings, rising past Barcelona and London, with a total volume of ¤874 million (a 90% increase over 2022), pushed by high-profile transactions such as The Westin Paris - Vendôme and the Hotel California, with investors securing hotels ahead of the 2024 Olympics to be held in the French capital. As a result, London fell to second place, with single asset investment volume of ¤565 million, a 53% decrease over 2022;

- The transaction of the luxury Mandarin Oriental and SOFIA hotels in Barcelona resulted in the city being the third most active single asset investment location in 2023, with ¤389 million in transactions (a 223% increase over 2022), and with an average price of ¤633,000 per room;

- Driven by the sale of the Comfort Vesterbro and The Square hotels, Copenhagen was the fifth most active city in Europe for single assets (128% increase over 2022). Copenhagen made up a majority of the Danish transaction market, accounting for 85% of the country’s total volume.

Investor Type

- Owner-Operators were 2023’s largest net buyers of single assets at ¤1.6 billion (an 84% increase over 2022);

- Private Equity companies were the largest net sellers of single assets in 2023 at ¤348 million. Real Estate Investment Trusts followed, with total net sales reaching ¤267 million;

- Institutional Investors were largely neutral in 2023 with a net acquisition volume of ¤37 million, after being responsible for single asset net purchases of ¤1.4 billion in 2022, demonstrating the significant effect on this segment in the current environment.

Capital by Continent

- Europeans were the most active buyers of single assets in 2023. They accounted for 76% of total transaction activity, with net acquisitions of ¤703 million, down from ¤1.1 billion in 2022;

- North American investors recorded ¤583 million in net sales, while the Middle East made net purchases of ¤696 million, accounting for 7% and 6% of total single asset transaction volume, respectively;

- 2023 saw renewed Middle Eastern interest (+182% on 2022’s investment volume) after being largely absent the past few years, with trophy acquisitions of The Westin Paris, Mandarin Oriental Barcelona and Le Richemond in Geneva.

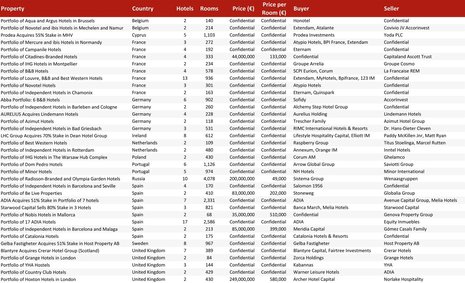

Notable Single Asset Transactions

Presented below is a selection of single asset transactions that occurred over the course of 2023.

To request an expanded list of transactions, contact gchamplong@hvshwe.com.

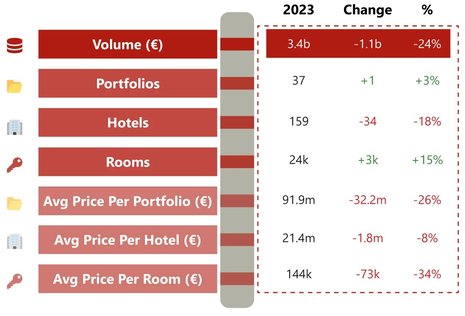

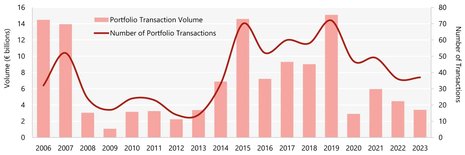

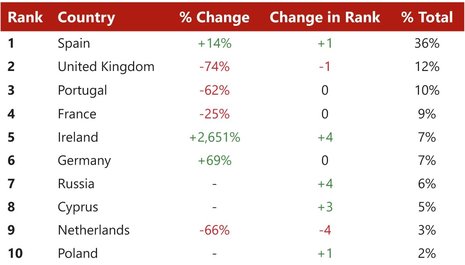

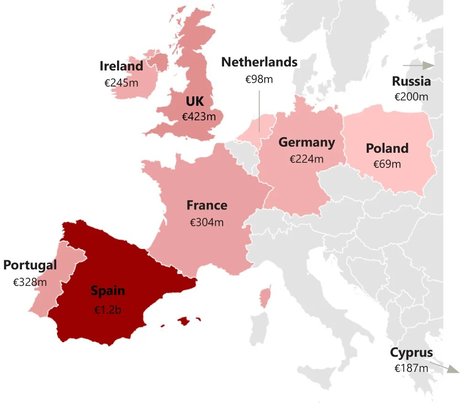

Portfolio Assets

Portfolio transaction volume declined in 2023 (-24% vs 2022). Spain was 2023’s most active transaction market for portfolios, with some of Europe’s largest deals taking place on the Iberian Peninsula, most notably ADIA’s two portfolio acquisitions, totalling 24 hotels, and Starwood Capital selling an 80% stake in three Meliá hotels.

Overall, both average prices per hotel, and per room, decreased from the previous year’s levels. 2023 portfolios saw more rooms on average per deal, but fewer hotels per portfolio than in 2022.

The UK once again saw high levels of portfolio transaction activity (second overall), including two Hoxton London hotels acquired by Archer Hotel Capital, Blantyre’s acquisition of Scottish Crerar Hotel Group and the Warner Leisure portfolio of two country club hotels.

Volume

- Portfolio transaction volume in 2023 was ¤3.4 billion, falling short of 2022 volumes by 24% and again amounting to the second lowest level of the last decade;

- This difference to 2022 was almost all attributed to the first half of the year, with H1 2023 portfolio volumes being only around 46% of that seen in H1 2022;

- By comparison, portfolio activity in the second half of 2023 was almost the same as in H2 2022, meaning that the second half of the year accounted for almost 75% of 2023’s total.

Cities

- Many of the portfolio assets that transacted in 2023 were in secondary, primarily leisure-focused cities, particularly in regional Spain, UK, Portugal and France;

- Madrid overtook London as the most active portfolio investment market in Europe, with ¤312 million in portfolio transactions, bolstered primarily by the ADIA acquisition, although representing a decline of 3% on 2022. Similar to 2022, Madrid accounted for a quarter of total Spanish portfolio transactions;

- London recorded the second highest city market volume, made up primarily of two Grange and two Hoxton properties, representing the majority of the total UK portfolio volume;

- Warsaw and Barcelona saw the third and fourth highest city portfolio volumes at ¤69 million and ¤64 million, respectively.

Investor Type

- Acquisition activity from Real Estate Investment Companies and Institutional Investors remained strong in 2023, accounting for 59% of all portfolio acquisition activity for the year;

- Private Equity investors were significantly less active than the year before, making up only 3% of total acquisition volume, compared to 21% in 2022;

- Owner-Operator investments doubled as a portion of total volume on the previous year, with an increased interest in asset-heavy branding conversions. Similarly, Hotel Investment Companies saw an increase of triple its investment portion of total volume compared to 2022;

- Owner-Operators, Institutional Investors (including ADIA) and Real Estate Investment Companies were net buyers, at ¤135 million, ¤893 million and ¤162 million of net purchases, respectively, while Hotel Investment Companies and High-Net-Worth Individuals disposed of a net ¤415 million and ¤324 million, respectively, as seen in Chart 18.

Capital by Continent

- Similar to 2022, European investors again accounted for the large majority of portfolio deal activity, at 73% of total volume;

- Led by ADIA, Middle Eastern buyers accounted for a quarter of total purchases, having been noticeably absent from portfolio deal activity in 2022;

- North American investors were absent in 2023, after having accounted for 21% of portfolio transactions the year before.

Portfolio Transactions

Presented below is the list of portfolio transactions that have occurred over the course of 2023.

Conclusion

Like the second half of 2022, 2023 was a year in which headlines were dominated by high inflation and high interest rates, which resulted in not only higher financing costs for acquisitions but also a rise in operating costs for hotels. In many hotels across the European continent, the latter was cushioned by strong top-line performances, but higher borrowing costs led to a softening of yields and a slow-down in transactional activity (bid-to-ask gap and scarcity of affordable debt) across all asset classes, including hotels.

Total European hotel investment volume for the year finished 19% below 2022 and 60% below 2019, with average deal sizes in Europe further declining, extending a trend that began mid-pandemic in 2021, driven mainly by a large drop in portfolio deals.

Despite this slowdown, transaction activity is still well above the six years that were impacted by the Global Financial Crisis (2008 to 2013), as well as 2020, and economic conditions are generally improving. The worst of this current cycle seems to be behind us, with inflation having fallen dramatically during the past 12 months and expected to be -3% in both the EU and the UK in 2024. Recessions in major economies have not been the trend but rather a rare exception, and interest rates seem to have peaked towards the end of 2023.

At the same time, the strong room rate growth experienced in many markets has reminded investors that hotels, although often having more immediately impacted returns than some other property investment classes, are also better insulated in high inflation periods due to their ability to re-price and grow room revenue.

Hotel transactions saw ¤1.5 billion worth of trophy assets, ¤2.0 billion worth in Iberian resorts (around 50 assets) and ¤1.5 billion in significant portfolios being traded, with a number acquired by first-time buyers within the High-Net-Worth Individuals and Family Offices investor types. Middle Eastern investors had significantly increased activity compared to 2022, up by 477% in total volume.

Spain and France drove a large proportion of activity, accounting for 44% of total investment volume, emphasising the focus on southern European leisure markets and dethroning the UK for 2023. The investment landscape also witnessed reduced core asset activity compared to previous years (2021 and 2022), with investor interest primarily focused on value-add assets in 2023. There were also far fewer distressed sales than many initially anticipated for the year.

Overall, many investors continued to hold a ‘wait and see’ position. Looking ahead, however, there is plenty that seems promising for the hotel investment market in Europe.

Looking Ahead

Central to the discussion of 2024’s investment outlook is the availability of, and cost of, financing, as well as the likelihood or otherwise of refinancing distress. As a greater volume of debt facilities become due for refinancing in the year ahead, there may well be more distressed sales, albeit far fewer than during the Global Financial Crisis, and perhaps, like during the pandemic years, a lot fewer than many anticipate. This time around, banks are better able to assess risk, as post-COVID trading continues to stabilise. Interest rates also look to have peaked and there is more visibility in lending terms. Increasing competition between local lenders and a widening of the pool of pan-European lenders – along with a willingness to lend on hotel assets relative to other real estate asset classes – should see the availability of hotel financing continue to improve.

This financing environment will be the key driver for increased investment activity. With economic headwinds trending more positively and inflation falling significantly, interest rates are expected to trend down again. There is still a ‘wait and see’ attitude by many investors, hopeful that this strategy will come to fruition when rates do start to fall in the second half of this year, or significant refinancing distress presents investment opportunities.

Europe has some major sporting events to look forward to in 2024, including the Olympic Games in Paris and the 2024 UEFA European Football Championship in Germany, as well as Taylor Swift’s 2024 Eras Tour across Europe, which are all set to deliver very strong top-line results during and around these events.

Investment trends that are becoming more prevalent include increased investor requirements for sustainably-certified energy efficient buildings, as well as for green financing. In addition, the rise in brand offerings and differentiation by various hotel groups will continue to lead to increased conversion acquisitions and disposals.

As 2024 progresses, a huge weight of capital remains ready to be deployed, especially in urban markets, with cities like London expected to pick up pace in the coming year. Q1 investment activity in 2024 has started strongly compared to the same period in 2023, with some notable transactions taking place, including the Mandarin Oriental Paris, in France, and the 10-asset Radisson Blu Edwardian portfolio and the 66-asset Travelodge portfolio, both in the UK.

[1] Only transactions above ¤7.5 million are considered in this analysis.

High cost of borrowing contributes to 19% fall in European hotel transactions in 2023

HVS

https://www.hvs.com/

1400 Old Country Road, Suite 105N

USA - Westbury, NY 11590

Phone: +1 (516) 248-8828

Fax: +1 (516) 742-3059

A New Approach to Hotel Management Fees | By Marcus Lee

THE PLAYERS Championship’s Impact on Jacksonville Hotels in 2024 | By Angela Lahti

Europe Hotel Transactions Bulletin - Week Ending 19 April 2024