U.S. hotel commentary - January 2024

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

U.S. hotel commentary - January 2024

|

Top-Line Metrics (January 2024, percentage change from January 2023):

- Occupancy: 51.9% (-1.7%)

- Average daily rate (ADR): $146.33 (+2.7%)

- Revenue per available room (RevPAR): $75.99 (+0.9%)

Key points

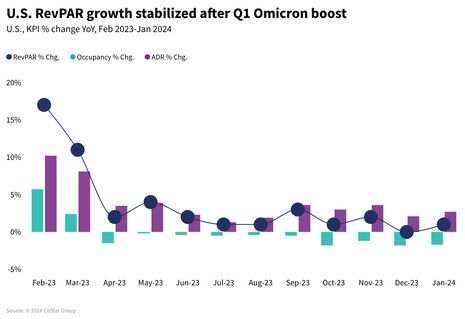

- January produced modest RevPAR growth, reflecting the continued return to pre-COVID patterns of low single-digit gains.

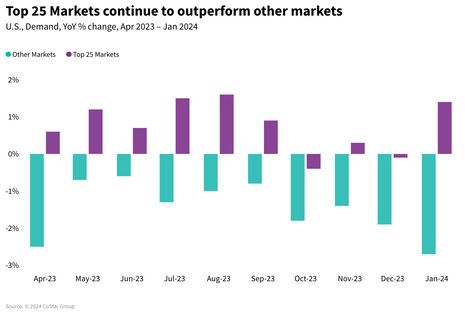

- The Top 25 Markets continued to outperform all others in aggregate.

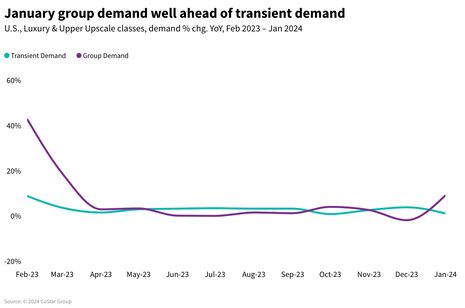

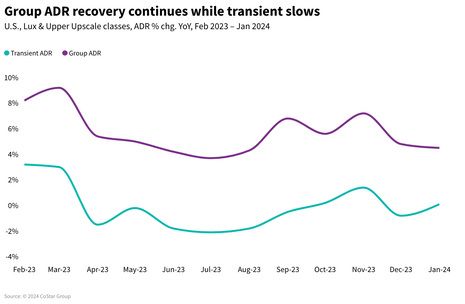

- Group demand and ADR continued to outperform transient.

- Upper Upscale and Upscale chains led industry performance, boosted by recovering weekdays and group demand.

- The 2024 RevPAR growth forecasted has been maintained.

- Forward booking levels are up through May with a pause in March for the Easter observance.

- Planning activity is growing in the pipeline, which will result in more robust supply growth in 2025 and beyond.

RevPAR showed modest year-over-year (YoY) growth in January, reflecting a return to pre-COVID patterns of low single-digit gains. RevPAR was lifted by a healthy ADR increase, which was partially offset by an occupancy decline. Demand across the U.S. has declined year over year for the past 10 months. Fortunately, supply increases have remained modest and are expected to remain low for the rest of the year as the pace of rooms in construction has slowed. Looking further out, projects in planning are on the rise, which will put more pressure on occupancy next year. As a counter, inbound travel is expected to strengthen, after being at a deficit over several years, which should help ease this pressure.

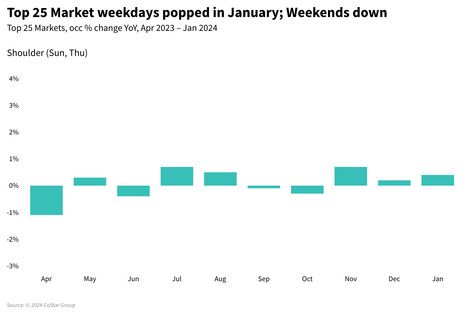

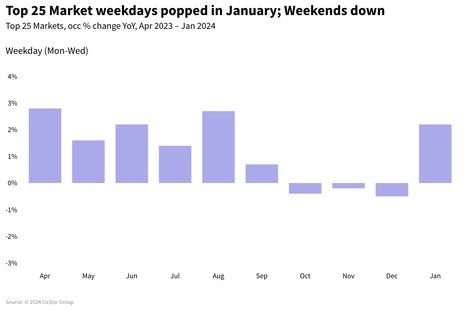

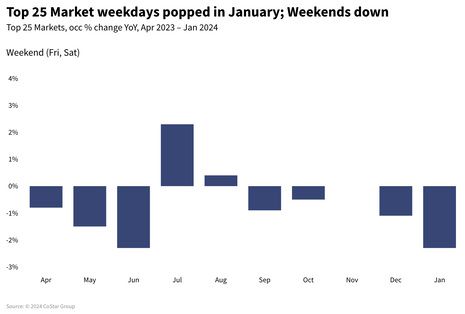

Slowing weekend travel was primarily responsible for the occupancy decline in January along with a modest decline in weekday and shoulder period travel. Weekends produced the weakest ADR growth, increasing only slightly, while weekday ADR increased well ahead of the pace of inflation.

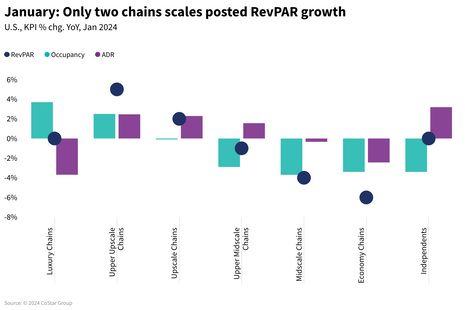

Upper Upscale and Upscale chains posted moderate RevPAR growth for January following a strong performance in 2023. An ADR increase drove Upscale, while Upper Upscale benefited from both occupancy and ADR increases. Upper Midscale’s RevPAR decline was driven entirely by occupancy with some impact due to supply growth. Midscale and Economy RevPAR declined throughout 2023, and the pattern continued in January with occupancy declining the most even while supply declined.

Chain Scales

Luxury and Upper Upscale chains saw demand growth in January with Luxury seeing the greatest boost. For the lower three chains scales, steady demand declines continued into January. Midscale chains saw the greatest decline followed by Economy and Upper Midscale. Over the past five years, there appears to be a structural shift in the Economy segment with a significant number of properties closing and/or moving out of the segment.

After seeing record-breaking ADR in 2022, Luxury hotels reported a decline as ADR dropped from $425 to $419 in January. The next three chain scales (Upper Upscale, Upscale, Upper Midscale) have recorded ADR growth for the past 10 months. Midscale and Economy saw ADR decreases over the past four months.

January RevPAR percentage changes ranged from +5.0% in Upper Upscale to -5.8% in Economy. For most chain scales, RevPAR growth was strong due to ADR gains, and RevPAR declines were generally impacted more by occupancy than ADR.

Segmentation

For hotels in Luxury and Upper Upscale classes, improving group demand was the major story moving into 2024. Group demand increased 9% compared to last January. Further, every week in January posted an improvement over the same week a year earlier. Transient demand just barely stayed positive at the start of 2024. ADR revealed a different story. Group ADR continued to recover throughout 2023 and into January 2024, staying above the rate of inflation, while transient ADR growth appeared to have stalled, declining in seven of the last 10 months with January transient ADR growth flat.

Markets

The Top 25 Markets saw growing room demand in 10 months in 2023 and continuing into January. Weekdays produced the strongest gains for the Top 25 Markets with occupancy up 2.2% YoY. Shoulder days were up 0.4%, while weekends declined 2.3%. In the remaining markets, occupancy was down. As with the Top 25 Markets, weekends took the biggest hit, down 3.1% with smaller decreases on the shoulder days (-0.9%) and weekdays (-1.5%).

ADR growth in the Top 25 Markets was stronger than the rest of the country with every month since July producing a month-over-month increase. January ADR increased 3.3%, partially impacted by a strong performance in Las Vegas. Las Vegas represents almost 9% of the room supply in the Top 25 Markets so a good month in Vegas makes an impact. All but two of the Top 25 Markets—Los Angeles and Philadelphia—saw year-over-year ADR growth in January. Across the rest of the country, ADR growth continues at a slower pace than the Top 25 Markets.

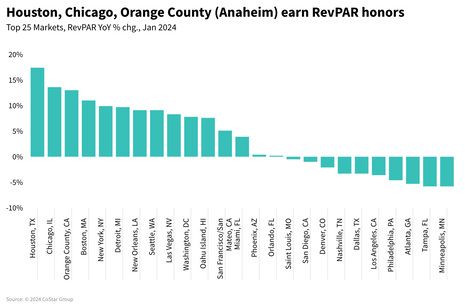

Top 25 RevPAR was up 3.9% in January as compared to -1.6% for the remaining markets. Fifteen of the Top 25 Markets saw increased RevPAR. Last year, all Top 25 Markets increased RevPAR due to the easy Omicron comp from 2022.

Pipeline

The number of rooms under construction decreased in January compared to the prior year although it increased from December which was expected. Looking back the last five-plus years, December construction activity has always been low due to some projects in construction finishing up, while new projects don’t break ground until after the holidays. Over the past 12 months, the number of rooms under construction continued to trail the previous 12 months.

Pipeline leaders—Upscale and Upper Midscale—continue to dominate the construction phase, however, the pace for these hotel classes has declined compared to 2022. Rooms under construction in these two classes have also slowed compared to last year, while Midscale and Economy rooms under construction increased.

Projects in planning, however, continue to grow with rooms in final planning up 18.4% and planning increasing 34.7%. Overall, more than 747,000 rooms (6,344 hotels) sit in the pipeline with rooms up 19.3% from last year.

Latest Weekly Data

Along with slowing growth week to week, U.S. occupancy has consistently declined year over year since the calendar turned to 2024. Read more here.

*Note: All financial figures presented in $.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

U.S. hotel commentary - February 2024

Click here to view the original version of this article.

STR

https://str.com

735 East Main Street

USA - Hendersonville, TN 37075

Phone: (615) 824-8664

Fax: (615) 824-3848

Email: info@str.com

STR Weekly Insights: 28 April – 4 May 2024

U.S. hotel results for week ending 4 May

STR Weekly Insights: 21-27 April 2024