Post-pandemic, hotels look to attract lost group demand | By Heidi Banak

Post-pandemic, hotels look to attract lost group demand

|

As U.S. hotels continue to recover from the devastating effects of the pandemic, leisure travel has been a boon for the industry. Recent studies, in fact, suggest that leisure travel will reach prepandemic levels in 2022. However, not all hotels cater to the leisure segment, leaving a large swath of properties that cater to group demand behind the curve. The meetings industry, and the hotels that support it, have suffered considerable losses since 2020. And while pandemic concerns ease, there is still widespread agreement that group demand will be the last segment to recover.

Hotels that cater to groups will find the need to ramp up sales efforts quickly amid a much different, and likely permanently altered, landscape for meetings.

How Group Got Here

After experiencing steady increases in occupancy and average daily rates for the past 10 years, the devastation brought on by the pandemic was felt industrywide at a level estimated to be as much as nine times greater than the effect of 9/11. Key performance indicators for 2020 and 2021 were down significantly from prepandemic numbers in 2019, especially for full-service hotels.

The decline in 2020 was unprecedented and, thankfully, unlikely to be repeated. The industry remained optimistic in early 2021, forecasting group and business travel to begin to rebound in the third quarter. However, the emergence of the delta and omicron variants quickly reduced those hopes for late 2021 and early 2022. As many companies continue to work from home, conferences and conventions have either been postponed or become virtual, affecting business and group travel across many markets.

While the increase in leisure travel and the higher rates paid by leisure travelers have had a positive impact on hotels, occupancy at full-service hotels (that more often cater to group demand) was 15 points lower in 2021 compared to 2019. Leisure travel has not been and will not be enough to raise the vast majority of full-service hotels to prepandemic levels for two main reasons:

- Many full-service hotels are not in leisure markets.

- Full-service hotels with 300 rooms or more often depend on up to 60 percent of their business to come from group business.

Without group demand, these hotels must operate under vastly different models to which they have been accustomed and be able to pivot to capture this returning demand.

How Group Demand Will Drive Recovery

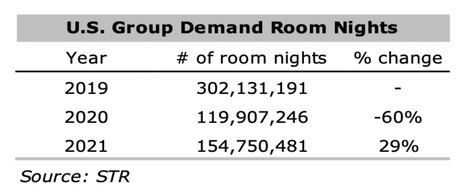

The effect on group demand cannot be overstated in its impact. The following table shows how many roomnights were impacted in group business from 2019 to 2021:

These numbers indicate that while the segment rebounded slightly in 2021, it is still little more than 50 percent of 2019 levels. As an example of the impact, we can consider two hypothetical hotels in the same market. We can see how group business at one hotel can have a positive impact at another.

- Hotel A has 500 rooms and 50,000 square feet of meeting space

- Hotel B has 200 rooms and 10,000 square feet of meeting space

During a healthy economy, these hotels typically rely on approximately half of their rooms revenue to come from group and meeting business. As Hotel A works to sell 300 group rooms to groups at a discount rate, the 50 percent occupancy gives rise to confidence to increase the pricing of the remaining guestroom inventory to sell to individual travelers.

Competitor hotels, like Hotel B, see this higher price point at Hotel A and adjust their pricing to be in line with the higher rates. In simple economic terms, the group business decreases the supply of available rooms on a day in the market, allowing prices to increase to accommodate demand. Without a base of group business, the exact opposite is true. Discounted rates will be offered for all the rooms at Hotel A in order to attract demand and fill the hotel. Hotel B will monitor the pricing and adjust it to be in line with the lower prices.

As a simple example, Hotel A is recognized in the market as a nicer hotel and typically prices its guestrooms at $220 and averages 75 percent occupancy. Hotel B typically prices its guest rooms at $200, $20 less than Hotel A.

On a particular night, Hotel A has secured 250 rooms of group business at a discounted rate of $190 per room night. The hotel has to sell 125 additional rooms to reach 75 percent occupancy. With the group base, the hotel can price the remaining rooms at $250 and reach 75 percent occupancy and will likely increase their prices higher if demand exceeds 75 percent occupancy. Hotel B will price its rooms at $230 ($20 less than Hotel A). The addition of group rooms has increased room revenue at Hotel A 5 percent. This example does not include catering, audiovisual, restaurant and other ancillary revenues that are attributed to group business.

This example assumes that the group business demand injected into the market is enough for Hotel B to achieve 75 percent occupancy at the higher rate. However, if the additional demand is not enough for Hotel B to get to 75 percent occupancy, the property will need to sell 117 rooms at $230 to reach $27,000 in revenue, equal to the property’s revenue without any group business in the market.

Given the expected percentages of group demand and the symbiotic relationship between competing hotels, securing group business is necessary to expedite a recovery in ADR and occupancy for the entire hotel industry, and it is especially critical for full-service hotels that focus on this business.

Preparing for Recovery

As the pandemic begins to recede, the majority of full-service hotels must be prepared to capture group business when it returns. The hotel sales team needs to be in place and proactively connect with past contacts, solicit potential customers to drive awareness of their hotel, and respond quickly to every lead. Operators must understand how the meetings market has changed, perhaps long term, due to the pandemic and respond accordingly. Beyond cleaning protocols, hotels must have technology in place to offer hybrid meetings. In addition to reliable and speedy Wi-Fi, hotels must have cameras and lighting designed to capture, stream, and record meeting content from various meeting set-ups. This will be imperative for planners to cater to those comfortable traveling and offer those attendees not comfortable, the ability to receive the content virtually. It remains to be seen how operators can monetize those options to retain revenue among what will likely be a continuing trend.

Menu options may also change as the trend away from communal buffet meals has reshaped some food and beverage operations. It may still take time before planners and attendees are comfortable with traditional options. In the short term, table service, individual packaging, and additional staffing will be the new normal for group meals as demand ramps up. Hotels may also wish to offer additional opportunities for outdoor dining to make guests feel more comfortable. This may call for creative solutions. Perhaps there is opportunity to add rooftop dining or lounge to an existing property.

Light at the End of the Group Tunnel

Group guestrooms associated with meeting business will be the foundation of recovery for full-service hotels. As this demand returns, the group meeting environment will be extremely competitive and hotel sales teams must present their best offer initially to capture the group business quickly and put the hotel in a position to increase prices for individual travel opportunities. With business and group travel virtually eliminated in 2020 and 2021, and amid apprehension to travel and meet face to face, many hotels placed sales staff on furlough or eliminated the positions entirely. Hotels should be filling some or all of these sales positions, especially those responsible for securing group business.

Another proactive step is to re-evaluate technology and menu offerings to reflect a post-pandemic meeting environment. Full-service hotels should set goals to fill 30 percent to 60 percent of their hotel room inventory with discounted group business and be poised to capture the returning individual travel demand at higher rates. Hotels that wait to see the individual traveler return before filling group sales positions will experience a much longer recovery.

At the beginning of the group recovery, many operators may look to offer discounted rates and incentives. Speed will be the most important attribute and hotels are not in a position for complex negotiating. Offering these perks on the front end could help to ramp up sales and ensure a faster recovery amid what will be a competitive environment. The long-term profitability and survival of the vast majority of full-service hotels will only come from having base group business booked in the hotel, giving the property confidence to charge higher retail rates for the returning individual travel demand and ultimately driving profitability.

Conclusion

Though rumors of group demand death have been wildly exaggerated, it will take time, effort, savvy operations and an “all hands-on deck” approach to drive full-service hotel recovery. Leisure alone cannot bring the industry back to prepandemic levels. The meeting landscape is the most affected segment of the hotel industry and the one to see the most dramatic shift in operations as demand ramps up. Savvy and forward-thinking operators will have a leg up in seeing their properties return to prepandemic levels as they help bring the entire industry into a robust and lasting recovery.

Click here to view the original version of this article.

Heidi Banak

Phone: +1 216 228 7000 ext 14

Email: hbanak@hladvisors.com

Hotel & Leisure Advisors (H&LA)

www.hladvisors.com

14805 Detroit Avenue | Suite 420

USA - Cleveland, OH 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Email: dsangree@hladvisors.com

Waterparks Maintain Momentum in 2024 Amid Growth and New Opportunities | By David Sangree

Man-Made Lagoons Gain Popularity | By Stephen Szczygiel