Kalibri Labs Ahead of the Curve: Miami, FL

Kalibri Labs Ahead of the Curve: Miami, FL

|

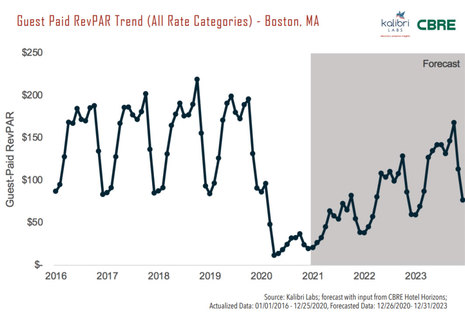

Boston's occupancy levels have been generally stable and well above their 20-year average since 2011. The year-end 2019 level of 75.6% was meaningfully higher than the longer-term average of 70.2%. RevPAR increased at an average annual rate of less than 0.8% since 2015, well below the Top 25 market average increase of 1.2% for the period. While occupancy levels pre-pandemic were attractive, strong supply increas- es and weakening international travel demand caused by a strong U.S. dollar environment hurt pricing power in recent years in Boston. • The estimated decline in the Boston hotel occupancy level from 2019 to year-end 2020 is -61.1%, significantly worse than the Top 25 market average decline of -48.3%. As a result of this weak occupancy level, the estimated decline in ADR for Boston in 2020 is significantly more than that of the Top 25 market average (-38.5% vs. -26.4%). These Occupancy and ADR contraction levels are expected to have resulted in a -76.0% decline in RevPAR for Boston in 2020 (vs. a -61.9% for the Top 25 market average). The Boston 2020 RevPAR contraction is one of the worst among the 65 markets tracked closely by CBRE (In contrast, the national RevPAR level is estimated to have declined by 50.9%; Jacksonville by 36.1% and Tucson by 34.2% in 2020 - best in the nation).

The weak pricing environment that has persisted in Boston since 2015 (as noted above) will serve to prolong a recovery as Boston and the nation move towards a post-pandemic environment. While Boston is expected to return to 2019 RevPAR levels in 2025 (later than most), the previous peak RevPAR level of $154.02 will not likely be achieved until the later years of this decade. RevPAR change from 2020 through 2024 is forecast to average +42.6% during this period (well-above the Top 25 market average of 28.4%).

Like other urban, coastal markets, the delayed recovery anticipated for the Boston market comes from the historical reality that group-related demand and inbound international travel have represented a significant percentage of total accommodated demand at a comparatively high Average Daily Rate. A rebound in group, convention and international-related demand will be required to insure a return to pre-Covid-19 levels of performance.

Click here to download the full report

About Kalibri Labs

Kalibri Labs evaluates and forecasts revenue and cost of acquisition performance in the digital marketplace. Our next-generation HummingbirdPXM platform is the only hotel benchmarking and reporting solution driven by AI and machine learning. HummingbirdPXM is built on a robust database of daily transactions and cost of acquisition data gathered weekly from almost 35,000 hotels. Using advanced algorithms, the platform enables owners and operators to determine a hotel's optimal business mix and manage resources to achieve it. Kalibri Labs unpacks the composition of RevPAR to describe market demand by rate category and channel assisting hotel owners and operators to develop strategies that improve profit contribution, which leads to higher asset values. Tapped regularly by the real estate and investment community, the Kalibri Labs database supports hotel transactions and financial restructuring by brokers, lenders, appraisers, and financial consultants. For more information, visit www.kalibrilabs.com.

Kalibri Labs

www.kalibrilabs.com

One Church St., Suite 300

USA - Rockville, MD 20850

Phone: 301.799.3222

Federal Policy Turbulence Impacts U.S. Hotel Demand, Finds Kalibri Labs

The State & Future of Hospitality: "Demystifying the Digital Market & Guide to Commercial Strategy" Empowers the Industry with Invaluable Insights and Expertise

Four Tips for Measuring Hotel Performance | By Sadie Garside